In some cases, you may want to have a different tax rate specific for your wholesale customer roles. This could be an incentive, for example, lowering the tax rate compared to the regular customer or complying with a specific regulation in your country.

We have made this possible in our WooCommerce Wholesale Prices Premium by introducing the Wholesale Role / Tax Class Mapping. It allows you to specify tax classes per wholesale role.

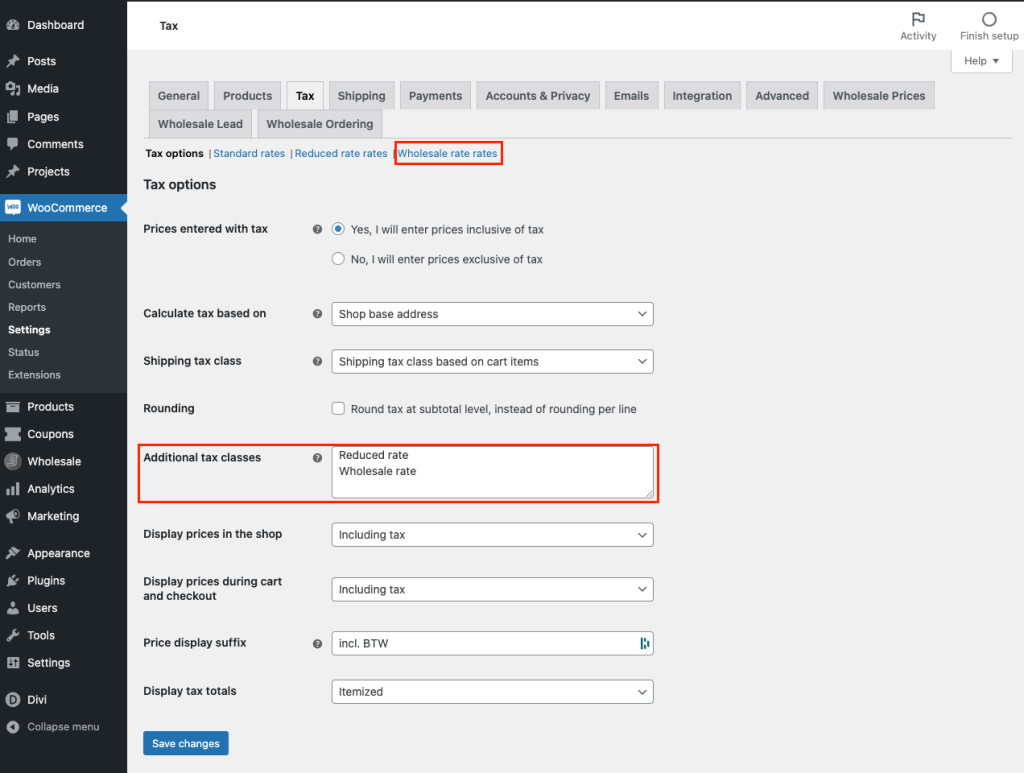

First, you’ll need to create a new tax class for your wholesale customer. Please navigate to WooCommerce > Settings > Tax then find the Additional tax classes option. Add a new tax class for your wholesale customer here, for example, wholesale rate.

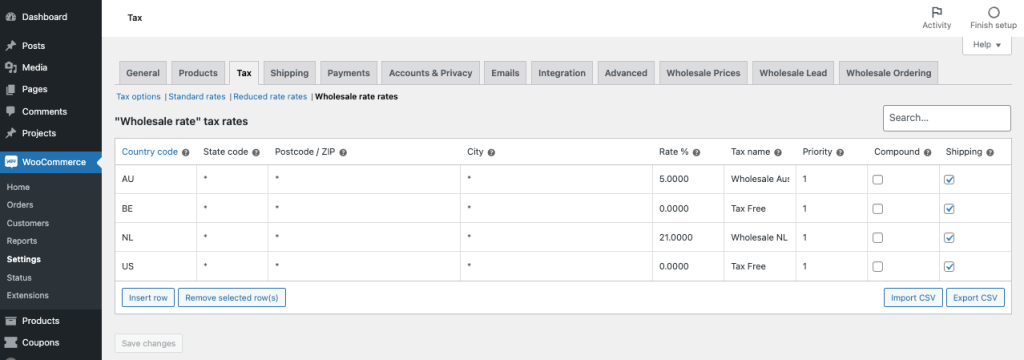

After you click save, you’ll find the new wholesale rate tax class option at the top. You can then set rate for each country or state here that is specifically for your wholesale customer. For more information about this, you can check WooCommerce documentation here.

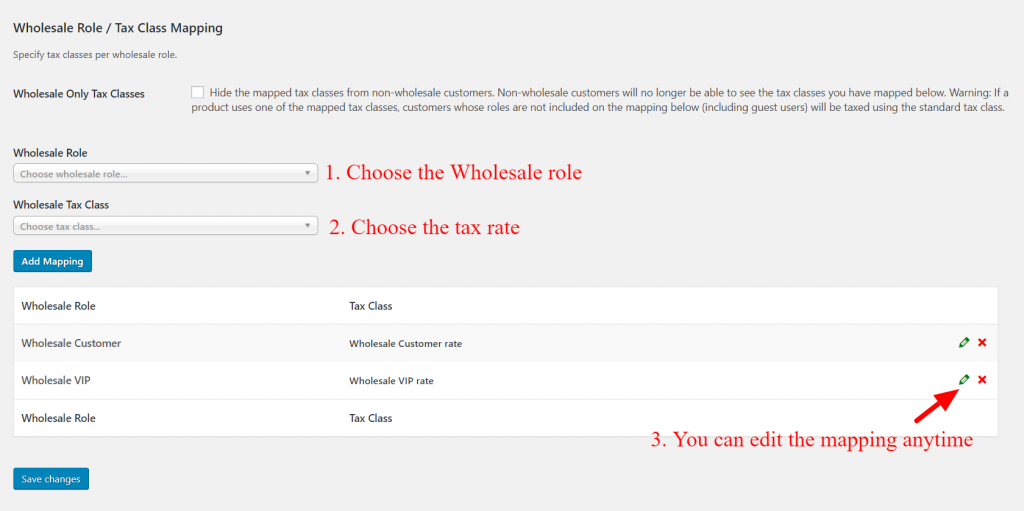

Then, you can map this new tax class you just created for your wholesale customer using Wholesale Role / Tax Class Mapping. You can find this options in WooCommerce > Settings > Wholesale Prices > Tax:

Simply select the wholesale role, then choose which tax class/rate your wholesale customers will get. You can change the tax class anytime later.

We recommend creating a special test user with your tax class role to let you test and ensure that things are working the way you want them to be. If it’s mapped correctly you should see that this user will have a different tax rate applied to their wholesale prices.