As a wholesale store owner, you need clever strategies to maintain a competitive edge and maximize profits. But did you know that one of the more effective tactics at your disposal involves setting up a different customer tax rate for B2B clients?

Yes, modifying your wholesale customers’ tax rate can serve as an incentive. For example, offering them a rate that’s lower than your regular customers’ can be particularly appealing. Of course, you could also modify the customer tax to ensure compliance with specific regulations.

This targeted approach lets you tailor your pricing structure specifically for your wholesale clientele, which offers distinct advantages for your business and customers.

Today, we’ll explore the reasons that make applying a different tax rate to wholesale customers a valuable strategy. Additionally, we’ll give you a brief tutorial on how you can do this yourself using the powerful WooCommerce plugin Wholesale Prices Premium.

So let’s begin!

Benefits Of Applying A Different Tax Rate To Wholesale Customers

Let’s explore some of the greatest advantages of modifying your wholesale customer tax rate.

1. Increased competitiveness

Wholesale stores enjoy a competitive advantage when they apply a customized tax rate to wholesale customers. This is because this strategy allows you to offer more attractive pricing to B2B clients. As a result, your store becomes more appealing compared to competitors that apply the standard tax rate across the board.

This pricing strategy can help you secure more business, expand your customer base, and potentially outperform competitors in your industry.

2. Strengthened customer relationships

So, what’s one of the things that happens when you apply a different customer tax rate to your B2B clients? Basically, you demonstrate a commitment to understanding and meeting their specific needs. And by tailoring pricing to accommodate their requirements, you can build stronger and more trusting relationships with your customers.

This personalized approach fosters loyalty, which, in turn, encourages repeat business. After all, wholesale customers feel valued when you show them that you appreciate their partnership.

3. Compliance with regional tax regulations

Implementing a different tax rate for wholesale customers can ensure adherence to various regions’ specific regulations – specifically unique tax requirements and incentives applicable to B2B transactions.

This approach helps you navigate the diverse tax regulations of different regions while avoiding potential penalties, legal issues, and complications that may arise from non-compliance. And when you demonstrate a commitment to operating within a region’s legal framework, you enhance your reputation and credibility.

4. Streamlined accounting and compliance

Implementing a separate customer tax rate for wholesale clients simplifies accounting and compliance processes. By clearly distinguishing between retail and wholesale transactions, you can maintain accurate records and facilitate easier tax reporting.

How To Apply A Different Tax Rate To Wholesale Customers (In 4 Easy Steps)

So, ensuring that your wholesale customer tax rate is distinct from your other clients’ can do your business a lot of good. But how, exactly, do you implement this strategy using your WooCommerce store?

Let our tutorial show you how! However, take note: for the steps below to be of use to you, you’ll first need to acquire, install, and activate two tools:

- The WooCommerce e-commerce platform

- Our Wholesale Prices Premium plugin

Wholesale Prices Premium is a WooCommerce expansion that allows you to set wholesale prices for your online store. Among many other things, it also gives you various ways to control how your wholesale customers are taxed.

So let’s get started!

Step 1: Enable taxes

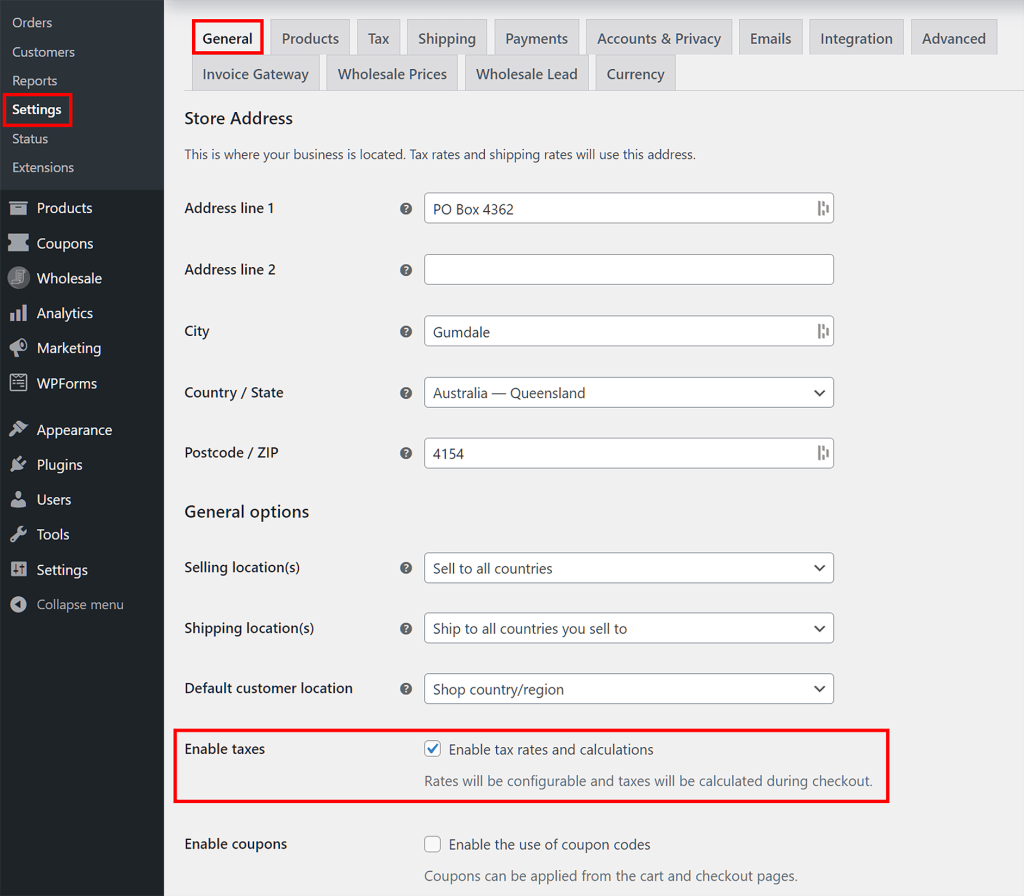

First, you need to make sure that taxes are enabled in your store. To do this, go to your WordPress dashboard. Then, click WooCommerce > Settings and select the General tab. Next, scroll down to Enable Taxes and tick its checkbox.

Now, you should be able to set a different tax class for wholesale customers.

Step 2: Create a new additional tax class

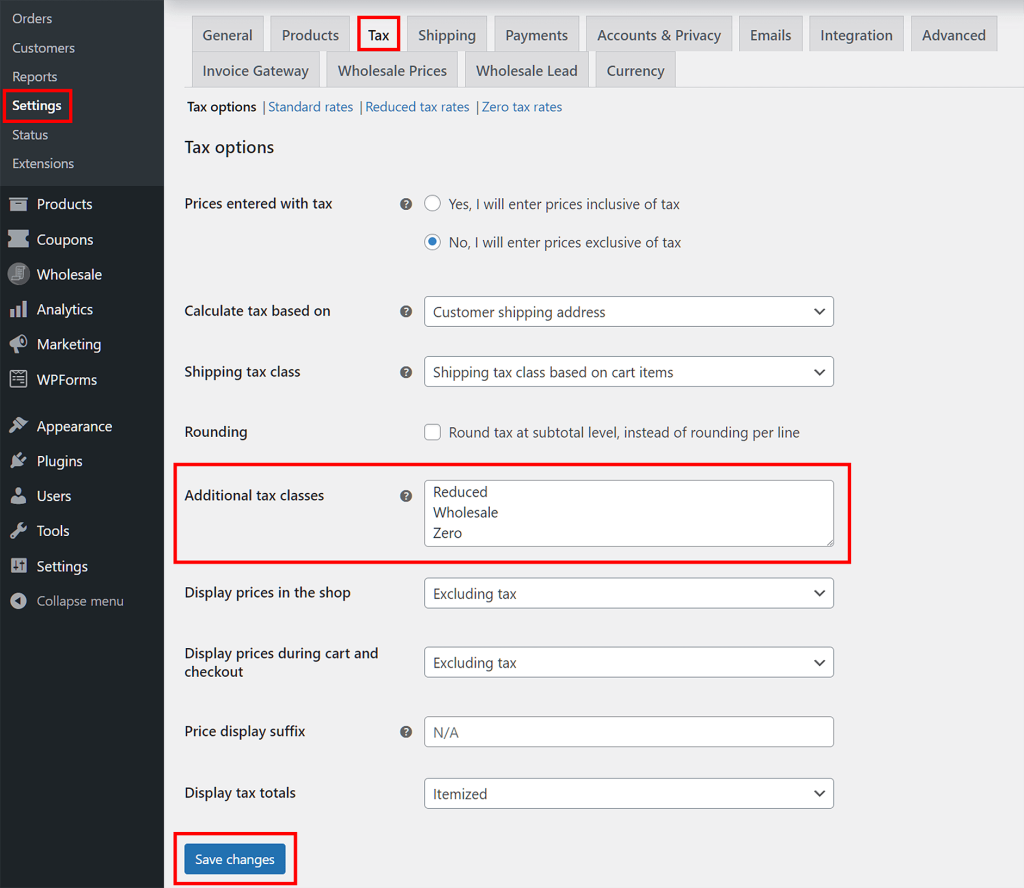

While staying in Settings, click the Tax tab and the Tax Options sub-tab. Then, scroll down to the Additional tax classes option.

In the entry field, add a new tax class for your wholesale customers. You can come up with any name for this tax class. For example, we’re simply calling ours “Wholesale.”

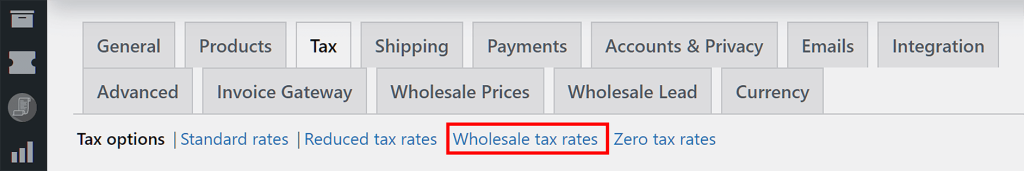

Now, click Save changes. This will create a new sub-tab under that Tax tab sporting the name of your new additional tax class. In our case, it’s “Wholesale tax rates.”

Onto the next step!

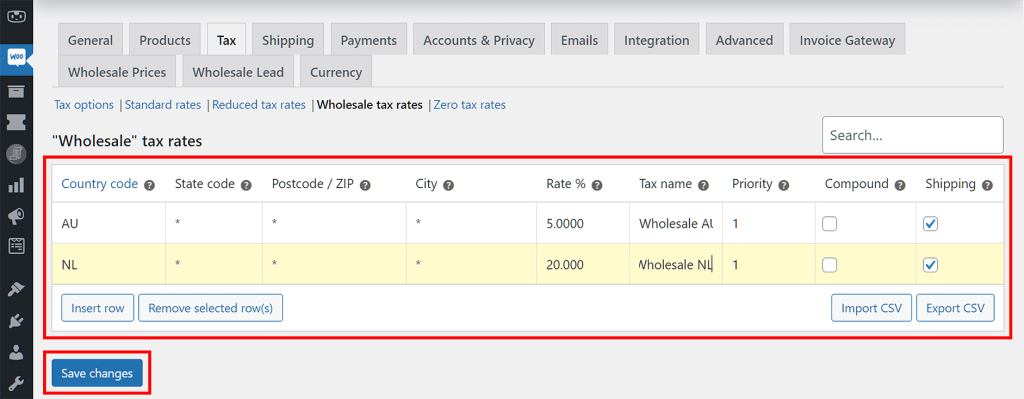

Step 3: Set your wholesale tax rate(s)

Click the new sub-tab. This will redirect you to a page with a tax class table, which you should populate with the customer tax rates of every region that you sell goods to.

First, click Insert Row to create a row on this table. Then, set a new wholesale tax rate for each country or state by filling this row with information. For quick pointers on how to do this, check out this WooCommerce documentation.

Simply click Insert Row every time you want to add a new tax rate. Don’t forget to click Save changes after every addition!

Step 4: Map the new tax class

Now, it’s time to map your newly created tax class to the wholesale customer role.

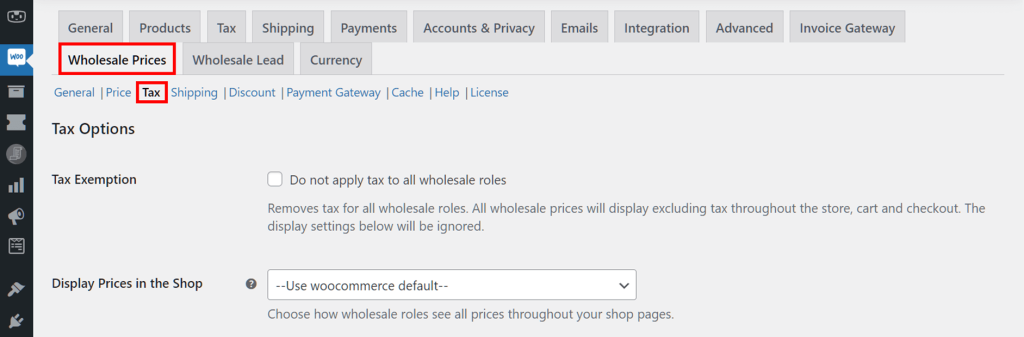

While on the WordPress dashboard, click WooCommerce > Settings. Then, select the Wholesale Prices tab and the Tax sub-tab.

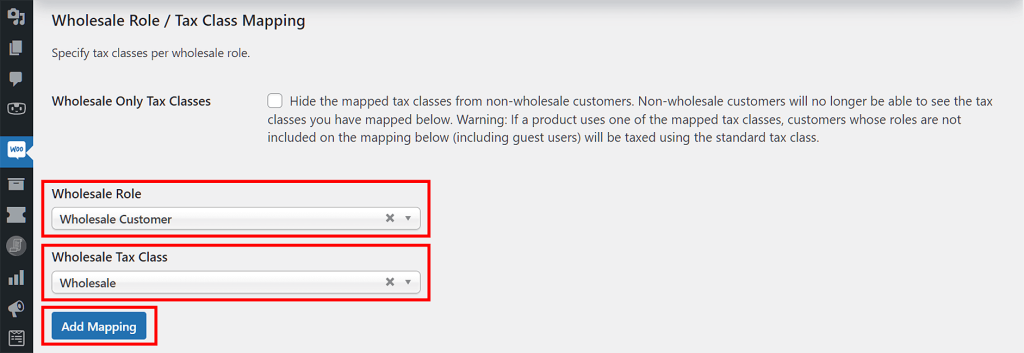

Next, scroll down to the Wholesale Role / Tax Class Mapping section.

Under Wholesale Role, choose “Wholesale Customer” from the dropdown menu. Then, under Wholesale Tax Class, use the dropdown menu to choose your newly created tax class, which in our case is “Wholesale.”

Once you’re done, click Add Mapping.

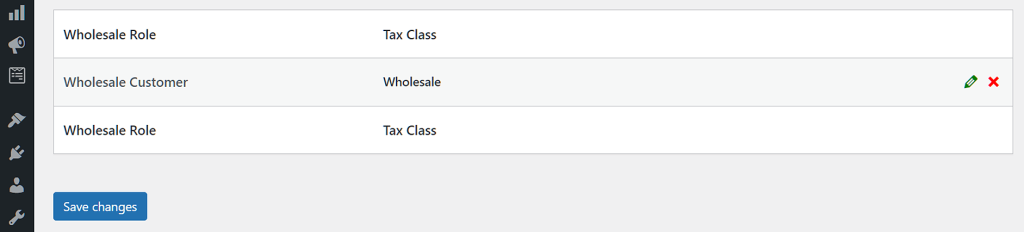

And that’s it! As you can see from the table below the Add Mapping button, the “Wholesale” Tax Class has now been mapped to the “Wholesale Customer” role. This means your wholesale customers will be taxed according to the wholesale tax rates you created in Step 3.

Continuing from our example, wholesale clients in Australia (AU) will get a 5% customer tax. Meanwhile, those in the Netherlands (NL) will get a 20% tax.

Keep in mind that you can edit or delete any tax class mapping anytime by clicking its green edit button or red delete button on the right side of the table.

When you’re happy with your work, click Save changes.

Conclusion

Applying a different customer tax rate to your B2B clients may be the strategy your business needs to thrive and succeed. After all, it can offer several benefits, including:

- Increased competitiveness

- Strengthened customer relationships

- Compliance with regional tax regulations

- Streamlined accounting and compliance

To apply a different customer tax rate to wholesale customers, use Wholesale Prices Premium to complete the following steps:

Remember: by recognizing the unique needs of B2B clients and tailoring pricing accordingly, you can optimize your operations, drive growth, and create a mutually beneficial environment between your business and your wholesale customers.

Do you have any questions about the customer tax rate? If so, please leave us a message in the comments section below; we’d be happy to hear from you!