Business-to-business (B2B) invoicing is a key process that helps businesses manage transactions smoothly. Whether you run a small business or a large company, understanding B2B invoicing can make a big difference in how well you manage payments.

In this article, we will explain what B2B invoicing is, give you tips for sending payments, and explore the benefits it offers. We’ll also introduce the Wholesale Payments plugin by Wholesale Suite, which is a great tool for making the B2B invoice easier than ever!

Ready to know the basics? Let’s begin!

B2B Invoicing Explained

B2B invoicing is when one business sends an invoice to another business. Unlike B2C transactions, B2B invoice is often more complex. It can involve bigger transactions, longer payment terms, and detailed records. A B2B invoice is an official request for payment that includes all the details of a sale, like product descriptions, quantities, and payment terms.

B2B invoicing is important for keeping cash flow, and make sure both the supplier and buyer have clear records of every transaction. Managing B2B invoicing properly can help you avoid late payments and keep your finances in order.

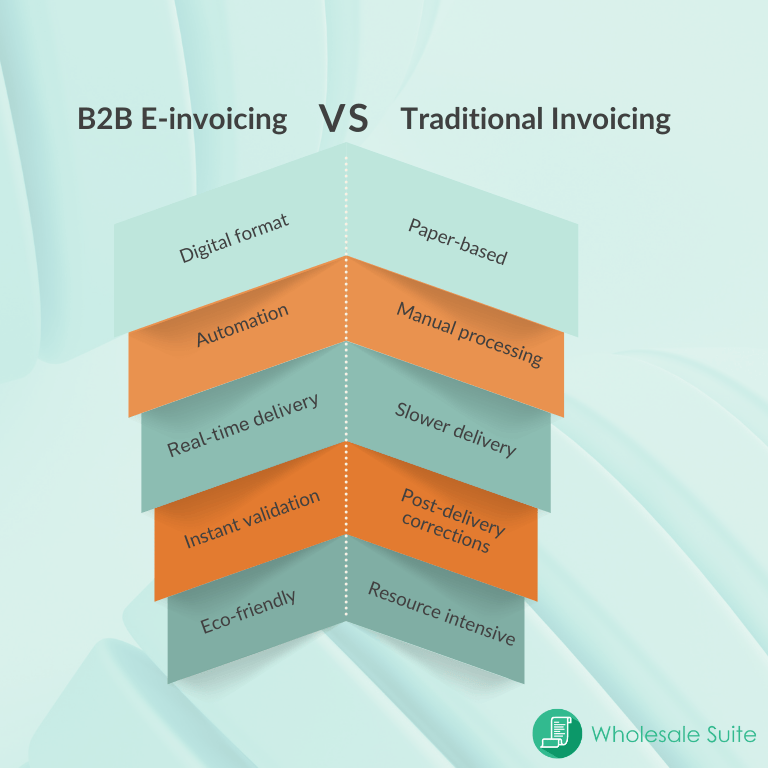

How Does B2B E-Invoicing Differ From Traditional Invoicing?

The main difference between traditional invoicing and e-invoicing is that e-invoicing is done digitally. Traditional invoices are on paper, which can be slower and lead to mistakes. With e-invoicing, businesses send and receive invoices online, which makes it faster and helps avoid errors.

E-invoicing saves time because there is no need for paper-based methods, which means payments happen faster. It also adds security since invoices can be tracked in real-time by making sure they reach the right person. The digital format of e-invoicing makes it easy to connect with accounting systems and financial software, which automates payment management.

Tips For Sending B2B Payments

Sending B2B payments doesn’t have to be hard. These tips will help make sure your B2B payments are accurate and easy:

1. Use e-invoicing tools

Switching to e-invoicing tools can save your business both time and money. These tools help reduce manual tasks like data entry, which means fewer mistakes. They also speed up the payment process by making it easier to send and receive invoices.

2. Provide clear payment terms

When you send an invoice, make sure all the payment terms are easy to understand. Clearly state the payment deadline, any late fees, and any discounts for paying early. This way, both you and your customer know what to expect, and there will be fewer chances of misunderstandings.

3. Double-check invoice details

Mistakes can cause delays and lead to disputes. Always double-check all the details on your invoice, such as product descriptions, quantities, and prices. Make sure everything matches what was agreed upon. Taking the time to do this can save you from bigger problems later on.

4. Automate recurring payments

If you have customers who make regular purchases, consider automating their recurring payments. This makes things easier for both you and your clients, as they won’t have to remember to make a payment each time. It also helps you maintain a steady cash flow without needing to send invoices repeatedly.

5. Follow up promptly

If a payment is overdue, follow up with the customer right away. Doing this in a polite but timely manner can help you get paid faster and keep your cash flow healthy. It also helps you avoid bigger problems if the payment remains unpaid for too long.

Benefits Of B2B Payments

This mode of invoicing offers numerous advantages that help businesses manage their financial processes more effectively and efficiently. From reducing manual errors to enhancing cash flow, there are several reasons why adopting e-invoicing can be a game-changer for your business.

1. Streamlined processes

One of the most significant benefits of B2B invoicing is the streamlined processes it provides. Automation tools reduce the time spent on manual data entry, which allows businesses to handle multiple invoices simultaneously and efficiently. With invoicing tools, companies can automate sending, tracking, and storing invoices, and make the entire process faster and more manageable.

2. Faster payments

Invoicing leads to faster payments by removing the delays often caused by traditional invoicing methods. E-invoices can be sent and received instantly, and many invoicing tools allow businesses to automate reminders for overdue payments. This helps speed up the payment cycle and ensures better financial health.

3. Improved cash flow

Effective invoicing helps improve cash flow. By establishing clear payment terms and making it easier for customers to pay promptly, businesses can maintain a steady inflow of funds. This means they are better positioned to meet financial obligations without delays.

4. Reduced errors

With this e-invoicing, the chances of human error are significantly reduced. Traditional paper invoicing often involves manual entry, which is prone to mistakes. Automated invoicing systems handle calculations and populate invoice fields, which minimizes the risk of incorrect information.

5. Enhanced record-keeping

Having all of your invoices stored digitally makes record-keeping more efficient and less prone to loss or damage. This improved accessibility helps businesses find information quickly when needed by supporting compliance, audits, and financial management.

6. Better client relationships

Timely and accurate invoicing helps maintain good relationships with clients. When customers receive correct invoices and understand payment terms clearly, these result in fewer disputes, and lead to stronger working relationships. Invoicing tools make it easier to keep track of communication and build trust with your business partners.

7. Customization and personalization

Invoicing allows businesses to customize invoices with personalized notes, logos, and branding. This adds a personal touch and conveys professionalism, which helps to enhance the overall customer experience.

8. Legal compliance

Compliance with tax regulations and industry standards is very important. Many B2B invoice solutions come with built-in compliance features, which makes it easier for businesses to follow local tax regulations and legal requirements without worrying about manual calculations or record-keeping.

Take Your Invoicing To The Next Level

Using B2B invoicing is much easier with the right tools, like Wholesale Suite’s Wholesale Payments plugin. This tool helps businesses make their invoicing process simple and fast. It has features made for B2B payments, making transactions smooth, payments quicker, and managing money easier.

Wholesale Payments lets you set up invoicing to fit your business needs. Whether you need to send one-time invoices or handle repeat payments, this plugin makes it easy!

Another great feature is that Wholesale Payments can send automatic payment reminders. This means you don’t have to follow up manually, which makes it easier to manage unpaid invoices and keep money coming in.

Wholesale Suite also offers other helpful plugins, like Wholesale Prices Premium, Wholesale Order Form, and Wholesale Leads Capture which work together to make managing wholesale customers smoother and more efficient. Take the hassle out of B2B invoicing with Wholesale Suite, so you can focus on what really matters—growing your business and reaching new heights!

If you want to learn about how to do invoice payments in wholesale, check out our article: How to Offer WooCommerce Invoice Payments to Wholesale Customers.

Frequently Asked Questions

What is B2B invoice vs B2C invoice?

A B2B invoice is used when a business invoices another business, while a B2C invoice is used when a business invoices an individual customer. B2B invoices often have more detailed payment terms, larger transaction values, and longer payment periods compared to B2C invoices. In contrast, B2C invoices are typically simpler, focusing on quick transactions and immediate payment. This difference helps each type of business effectively manage its transactions and relationships.

What does B2B mean in payments?

B2B means “business-to-business” in payments. It refers to financial transactions that occur between two businesses rather than between a business and a consumer. B2B payments can involve invoices for goods, services, or subscriptions, and are usually larger in value compared to business-to-consumer (B2C) payments. These payments are crucial for keeping supply chains running smoothly and ensuring that businesses can continue their operations efficiently.

How do I write a B2B invoice?

To write a B2B invoice, start by including your business information, such as the name, address, and contact details. Then, add the client’s information, including their business name and address. Next, list the products or services provided along with quantities, prices, and any applicable taxes. Clearly specify the payment terms, such as the due date and any late payment fees. Finally, include the total amount due and instructions on how to make the payment. Using an e-invoicing tool can help make this process faster and more efficient.

Conclusion

Invoicing is a crucial element for ensuring smooth financial operations between businesses. With these benefits, transitioning to digital B2B invoicing is a smart move for any business looking to optimize its financial operations and thrive in today’s competitive market.

In this article we discussed how B2B invoice could help your business thrive:

- B2B invoicing explained

- How does B2B e-invoicing differ from traditional invoicing?

- Tips for sending B2B payments

- Benefits of B2B payments

- Take your invoicing to the next level

By adopting B2B e-invoicing and leveraging tools like the Wholesale Payments from Wholesale Suite, businesses can streamline their processes, and improve relationships with their customers.

Anything you like about this article? Share it with us in the comments below!