The work doesn’t stop after attracting wholesale clients on your WooCommerce store, landing B2B deals, and delivering your products. To maintain healthy cash flow for your wholesale business, you also need to have an efficient B2B collections process. This ensures that your hard-earned revenue comes in on time, allowing you to invest back into your business and seize growth opportunities.

Well, you’re in the right place! In this guide, we walk you through key B2B collections best practices you can implement to help you boost your cash flow and drive sustainable growth for your business. Without further ado, let’s get right into it!

What Is B2B Collections?

B2B collections is the process of collecting outstanding payments from business customers. In the context of WooCommerce wholesale, this covers managing invoicing and payment collection for B2B transactions conducted in your online store.

When dealing with wholesale clients, businesses typically offer credit terms that allow customers to pay their orders at a later date. B2B collections encompass all the processes in place to ensure these invoices are paid on time, including:

- Generating Invoices: Sending invoices to wholesale customers promptly.

- Tracking: Monitoring the status of invoices, tracking payments made, and keeping an eye on outstanding balances.

- Following-up: Sending reminders to wholesale clients to facilitate payments.

- Managing Late Payments: Enforcing penalties or other measures to address overdue payments.

Why Improve Your B2B Collections Processes?

Establishing efficient B2B collections practices is critical for the success and financial health of your wholesale business. It allows you to:

- Improve Cash Flow: Timely payments from wholesale clients ensure a steady stream of revenue for your business. With financial resources available, you can cover your immediate expenses, invest back into your business, and maintain financial stability. It also makes you more resilient to changing market conditions.

- Reduce bad debt: Bad debt refers to outstanding balances that are deemed uncollectable, occurring when invoices go unpaid for an extended period. With efficient B2B collections in place, you can identify and address potential problems early and reduce the possibility of non-payment from B2B customers.

- Foster better customer relationships: Trust and credibility are crucial in B2B relationships. By establishing a smooth and transparent B2B collections process, you enhance the overall customer experience for your wholesale clients and build stronger partnerships.

- Streamline operations: Improving your B2B collections practices also entails investing in tools and technologies that automate the process. In turn, this helps you save time and reduce the risks of errors and oversights.

6 B2B Collections Best Practices To Improve Cash Flow

Now that we understand what B2B collections encompass and why it’s an essential aspect of your business, it’s time to dive into some actionable steps! In this section, we explore six best practices to help you streamline your collection processes and enhance cash flow!

1. Communicate clearly

The first step to improving your B2B collections process is ensuring clear and transparent communication with your wholesale clients. After all, a well-informed customer is more likely to understand their responsibilities and meet their payment obligations on time.

Therefore, clearly communicate your payment terms from the start. Make sure that your B2B buyers know their payment due dates, available payment methods, and late payment penalties. Don’t hesitate to send out friendly reminders to help your clients stay on track with their obligations.

Additionally, provide your B2B clients with reliable communication channels. It’s important that they know where to reach out for assistance when they have questions or concerns about their payments. Consider establishing a dedicated support email, phone, or live chat capabilities to accommodate these queries.

2. Screen potential wholesale clients

There is always a risk when you extend credit terms to B2B buyers, especially for new clients. However, you can mitigate these risks by qualifying or screening prospective buyers.

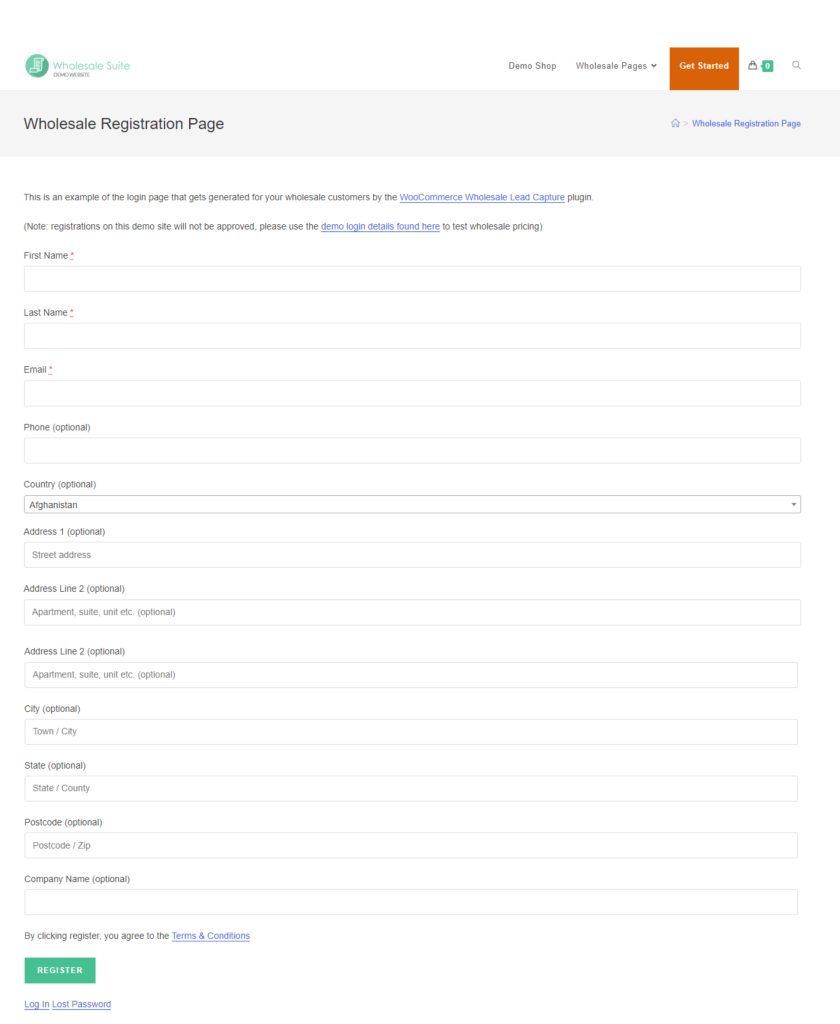

To do so, establish an onboarding process that allows you to gather key information from wholesale clients. An easy way to get started is by adding a custom B2B registration form on your website.

With a simple registration form, you can collect relevant information about your B2B buyers. For instance, your form can require company information, contact details, and specific fields for tax identification numbers or industry certifications. This allows you to assess the credibility of potential B2B buyers before giving them access to wholesale privileges and credit terms.

WooCommerce wholesalers can leverage plugins like Wholesale Lead Capture to implement this strategy. This tool allows you to add a customizable B2B registration form on your website and set an approval process to help you evaluate wholesale clients.

3. Provide flexible payment terms

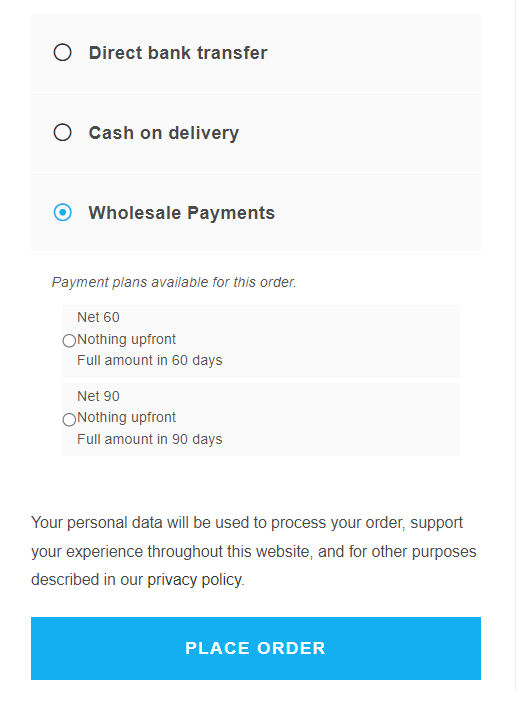

Another way to improve your B2B collections process is by offering flexible payment terms. Business clients often have varied financial capabilities and cash flow schedules. By offering options like installment plans, deferred payments, or extended payment schedules, you can make wholesale transactions more manageable for your clients.

The key is tailoring payment terms to meet the unique needs of your business clientele. Therefore, take time to understand your clients better. Consider conducting surveys or engaging in conversations to learn about their payment preferences.

Using plugins like Wholesale Payments, you can create fully customizable WooCommerce payment plans for B2B customers. This powerful plugin also allows you to tweak the accessibility of your payment plans to custom users and roles, ensuring only eligible B2B clients can access extended payment terms.

4. Automate invoicing

Automating invoicing is one of the most effective ways to improve your B2B collections process. With automated invoices, you save a ton of time, reduce the risks of errors, and ensure timely delivery of invoices to your wholesale clients.

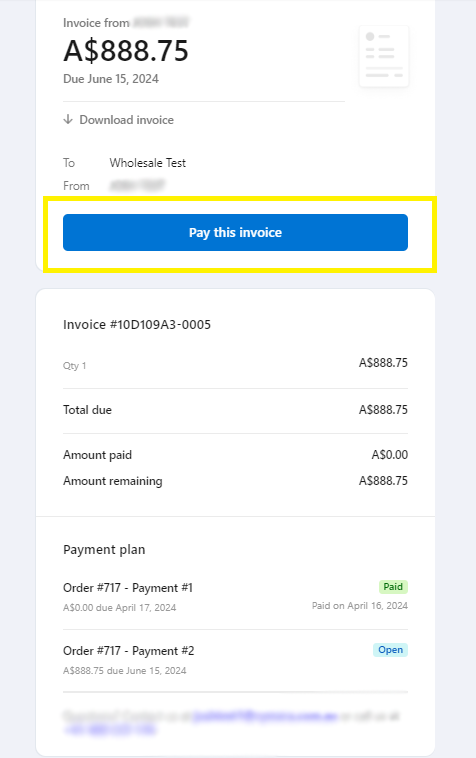

Fortunately, there are countless tools available to help you set this up effortlessly. A great example is the aforementioned Wholesale Payments. Apart from letting you offer flexible payment terms, this plugin also automates sending out invoices upon order placement. This ensures your B2B clients receive their invoices on time.

5. Make it easy for customers to pay

Improving your B2B collections process means removing potential friction and barriers to payment for your wholesale customers. Make it easy for them to pay by accepting multiple payment methods and making the process as seamless as possible.

For instance, Wholesale Payments allow B2B customers to pay right within their invoices and choose their preferred payment method, whether it’s credit cards or digital wallets. It also provides a detailed summary of their payment right within their WooCommerce account dashboard. By eliminating extra steps in the payment process and providing them with visibility into their transactions, you empower your B2B customers and instill confidence.

6. Set and enforce late payment penalties

To improve your B2B collections process, it’s crucial to define clear policies for late payments. This entails setting penalties for overdue invoices and communicating them to your clients. By setting these expectations from the outset, you can encourage timely payments and minimize the risks of overdue payments affecting your cash flow.

Firstly, clearly define your late payment policies in your contracts, terms of service, and invoices. There are several structures you can explore to implement this into your policies. For instance, you can set percentage interest rates based on the overdue amounts, or implement flat fees for a timeframe past the due date.

While it’s important to maintain good relationships with your business partners, it’s just as crucial to enforce your policies consistently for clients who fail to meet deadlines. Transparency is key–be diligent and strive to maintain fairness in your B2B relationships. This will help discourage repeated late payments and help foster trust with your business clientele.

Conclusion

Improving your B2B collections process is a crucial aspect of ensuring the success and sustainability of your wholesale business. By establishing a streamlined collection process, you can improve your business’s cash flow and invest in the continued growth of your venture.

In this article, we walked you through six actionable strategies to improve your B2B collections process. To summarize, let’s review them below:

- Communicate clearly

- Screen potential wholesale clients

- Provide flexible payment terms

- Automate invoicing

- Make it easy for customers to pay

- Set and enforce late payment penalties

Wholesale Payments, our newest addition to Wholesale Suite, enables WooCommerce wholesalers to streamline B2B collections in their online stores. With this plugin, you can automate invoicing, offer flexible payment terms to wholesale customers, and gain complete visibility into payments and outstanding invoices right within your WooCommerce dashboard!

Do you have any questions about improving your B2B collections process? Let us know in the comments section below.