Learning how to improve cash flow in business is crucial for the long-term success of your wholesale venture. After all, even with healthy profit margins, cash flow problems can still make it difficult to replenish inventory, pay bills, or invest in growth opportunities. Essentially, maintaining a healthy business cash flow keeps the light on for your business!

No worries, you’re in the right place. Bookmark this guide, for we will be revealing seven key cash flow optimization tips to ensure your business’ success. Without further ado, let’s get right into it!

What Is “Cash Flow”?

Cash flow is the movement of money into and out of your business.

Money coming into your business is referred to as “inflows,” and they typically come from sales, investments, and other sources of revenue. Outflows, on the other hand, are the cash that goes out of your business for expenses and obligations. Typical examples include operational expenses, debt payments, and inventory purchases.

Cash flow is a critical gauge of your company’s financial health and sustainability. When learning how to improve cash flow in business, the goal is to maintain a healthy, positive flow. Having positive cash flow means your business generates more cash than it spends, giving you the resources to cover your bills and invest in growth opportunities.

Cash flow vs profit: Why they are not the same

Profit and cash flow are related, but they are not the same thing. Profit is what you earn after expenses on paper. Cash flow is whether money is actually available in your bank account when bills and inventory payments are due.

This is why a wholesale business can look profitable and still struggle. If customers pay late, or if too much cash is tied up in inventory, you can run short even when sales look strong. Improving cash flow often means tightening timing, not just increasing revenue.

Cash Flow Forecasting For Wholesalers

A cash flow forecast is a simple plan that estimates incoming and outgoing cash over a set period. It helps you spot cash gaps early so you can adjust before you miss payments or delay inventory orders.

Here is a quick forecasting approach that works for wholesale:

- List expected cash inflows by week or month (invoice payments, deposits, new orders)

- List expected outflows (inventory purchases, payroll, rent, software, shipping, tax)

- Track timing, not just totals. The due date matters more than the amount

- Review it weekly and update it based on real payments received

Tip: Many teams use a 13-week forecast because it is detailed enough to catch short-term issues, but still easy to maintain.

How To Improve Cash Flow In Business: 7 Actionable Tips For Wholesalers

According to industry insights, 82% of businesses fail due to poor cash flow management. Thus, learning how to improve cash flow in business can be the difference between success and failure for your venture. In this section, we’ll explore actionable strategies to help you safeguard the financial health of your business and position it for long-term sustainability.

1. Manage your invoices & send them on time

Most wholesale businesses rely on invoice payments from their clients. Thus, timely and accurate invoicing is critical for a healthy cash flow. Consider leveraging an automated invoicing solution to reduce the risk of invoicing delays and errors. These tools automatically generate invoices, track payment statuses, and send timely reminders to clients.

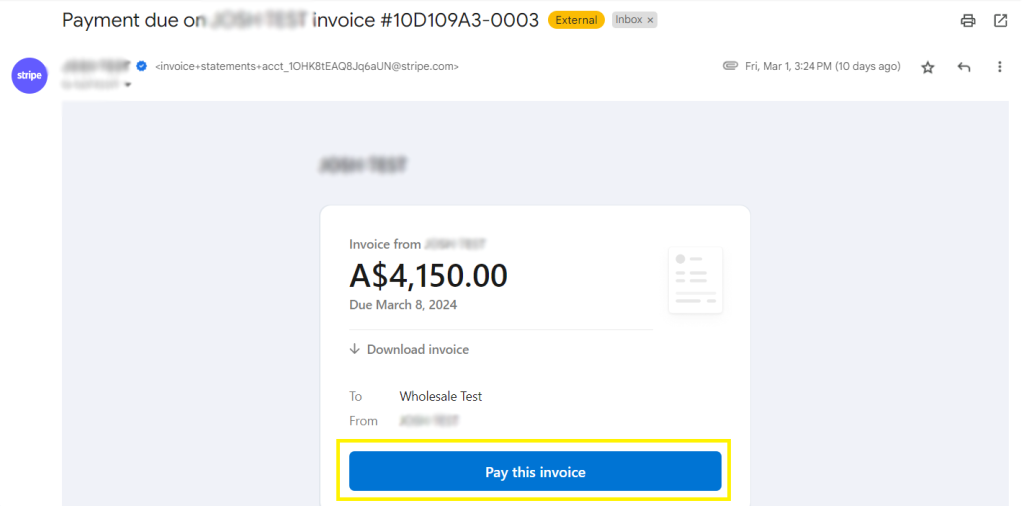

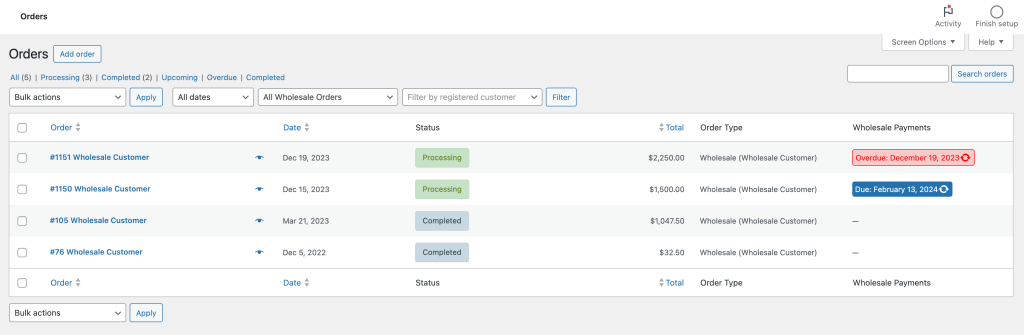

WooCommerce wholesalers, for instance, can take advantage of solutions like Wholesale Payments. This powerful plugin integrates seamlessly with the WooCommerce ecosystem, sending out automatic invoices to B2B clients, and providing full visibility into payments right within the WooCommerce dashboard:

This kind of transparency is crucial for maintaining smooth cash flow operations.

In addition to automated invoicing, make sure to include clear payment terms on your invoices. Outline amounts, due dates, accepted payment methods, and any fees or penalties for late payments. This sets clear expectations for clients, minimizing confusion or disputes regarding payment deadlines.

2. Offer flexible payment terms

One key strategy when learning how to improve cash flow in business is offering flexible payment terms. By providing B2B buyers with flexible payment plans and schedules, you reduce the risk of late payments and provide options that better align with their financial capabilities. Remember, when it comes to managing your cash flow, it’s better to receive payments in increments rather than deal with unpaid invoices.

Consider offering installment options for wholesale orders to make it easier for your customers to manage their cash flow. Breaking down payments into more manageable payments over time not only caters to the needs of your buyers–it can also make your products more accessible to new customers. Overall, this can contribute to a higher and more predictable stream of revenue for your venture.

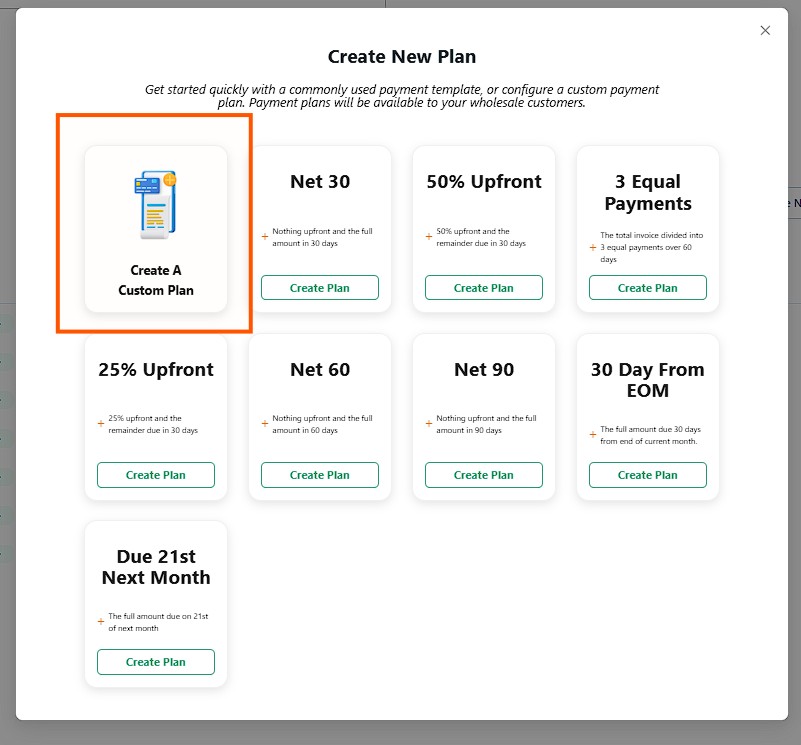

Solutions like Wholesale Payments are tailor-made for WooCommerce wholesalers who want to give their buyers flexible B2B terms. This plugin comes with pre-configured payment plans and allows you to create payment terms tailored to your customers’ needs.

3. Encourage clients to pay early

Customers love incentives, and you can make this work for you when it comes to improving your cash flow. By rewarding your customers for paying their bills early, you create a win-win scenario for them and your business!

Consider providing discounts for early payments. For example, you can offer a small percentage discount for payments made within a specific time period, such as 10 days from the invoice date. You can also can offer discounts on their next order, which encourages repeat business.

When implementing this tip, ensure that you make it easy for your clients to pay their invoices on time. Offer convenient payment channels including credit cards, bank transfers, and digital wallets. Additionally, make sure your customers are aware of the perks. Clearly highlight any discounts or incentives they may receive on their invoices and payment reminders. This reinforces the value of early payments and encourages them to take action.

4. Evaluate your operational expenses

Are there unnecessary operational costs that you can reduce or eliminate? By thoroughly evaluating your operational expenses, you can identify opportunities for cost savings and improve the financial health of your business.

Begin by evaluating each expense category and identify aspects where costs can be reduced. These include rent, utilities, marketing, supplies, and employee salaries. For example, you may consider selling underperforming assets, leasing equipment instead of buying them outright, or investing in new technologies to automate key processes in your business.

5. Improve inventory management

Inventory management is a crucial part of mastering how to improve cash flow in business, most especially for wholesalers. After all, you serve as a supplier for other businesses, and maintaining optimal inventory levels is important to meet their needs.

For optimal inventory management, it’s important to identify which stocks are weighing down your finances. This includes slow-moving or obsolete goods that tie up valuable capital and storage space. To identify these goods, conduct regular inventory audits. Then, implement strategies such as discounting or repurposing to clear excess inventory and free up cash for more profitable investments.

6. Assess your prices

Making changes in pricing is daunting for many business owners, but it’s a critical aspect of maintaining a profitable business. Conduct an assessment of your current pricing to ensure it’s competitive, sustainable, and in line with industry standards.

For instance, if you discover that your direct competitors are charging more, it may indicate that you can potentially increase your prices without scaring off customers.

It’s also important to analyze if your profit margins generate enough revenue to cover your costs and achieve a reasonable profit. Establish a healthy baseline for pricing by calculating your cost of goods sold (COGS), overhead expenses, and desired profit margins.

Increasing your prices doesn’t have to be daunting, as long as you’re transparent with your clients. When making price changes, clearly communicate the reasons behind the price adjustments, and emphasize the value of your offerings.

7. Negotiate with your suppliers

Mastering the art of negotiation is crucial to improving cash flow in business. By negotiating better terms with your suppliers, you enjoy cost savings and potentially increase your working capital. For instance, you can consider asking for volume discounts or rebates based on your purchase volume and order frequency. Another option is to request extended payment terms, installment options, and early payment discounts.

8. Track your cash conversion cycle

Wholesale cash flow problems often come from timing. A simple way to see this is the cash conversion cycle. It tracks how long it takes to turn cash spent on inventory into cash collected from customers.

Cash conversion cycle = DIO + DSO − DPO

- DIO (days inventory outstanding): how long stock sits before it sells

- DSO (days sales outstanding): how long customers take to pay

- DPO (days payable outstanding): how long you take to pay suppliers

Quick takeaway: If your cash conversion cycle is long, your cash is tied up. Faster inventory turns, tighter collections, or better supplier terms usually improve cash flow the most.

Conclusion

Maintaining a positive cash flow, as we’ve learned, is crucial for the long-term success of your wholesale business. With a healthy cash flow, you have access to financial resources to pay your expenses, invest in your business, and scale your venture.

In this helpful guide, we’ve walked you through seven key strategies on how to improve cash flow in business. To summarize, let’s review them below:

- Send out invoices early

- Offer flexible payment terms

- Encourage customers to pay early

- Evaluate your operational expenses

- Improve inventory management

- Assess your prices

- Negotiate with suppliers

- Track your cash conversion cycle

Fortunately, you can leverage powerful tools to optimize your cash flow management strategies. For example, WooCommerce wholesalers can use Wholesale Payments to automate invoicing, provide flexible payment terms, and gain visibility into payments and balances. By taking advantage of these tools and technology, you can streamline operations and achieve greater financial control.

We hope this article helped you out! Which of the strategies are you most excited to implement for your wholesale business? Share them with us below!