WooCommerce business owners like you can enhance customer satisfaction and drive revenue growth by offering flexible payment terms. If you’ve ever considered offering WooCommerce pay later options, you might have stumbled upon the term net 30/60/90. What exactly is net 30/60/90, and why does it matter for your wholesale business?

In this comprehensive guide, we’ll tackle what net 30/60 payments are, how they work, and why you should consider offering them in your business. Without further ado, let’s get into it!

What Are Net 30/60/90 Terms?

If you plan to offer WooCommerce pay later options to empower your customers and provide them with more flexibility, it’s essential to understand the concept of net payment terms. Net payment terms outline the timeframe within which a customer is expected to settle an invoice after receiving goods or services. These terms typically start upon the issuance of an invoice.

So, what is net 30/60/90? This is a common variation of net payment terms, outlining the timeframe of settling invoices in days. Net 30 grants your customers 30 days to complete payment upon issuance of an invoice; Net 60 gives them 60 days, while Net 90 gives them 90 days.

These three are just some of the most common payment terms, but depending on your industry, you may encounter other variations, such as 15, 45, or 80 days. In the next section, we’ll walk you through key reasons why you should consider offering net payment terms in your business.

Why Should I Offer Net 30/60/90 Terms In My Business?

Offering WooCommerce pay later options, such as net 30/60/90 terms, can provide several compelling benefits to your business. These terms empower your customers to make purchases and help you maintain a more predictable cash flow for your wholesale business.

By offering net payment terms, you can:

- Enhance customer satisfaction: WooCommerce pay later options, such as net 30/60/90, give your B2B customers increased control over their finances, allowing them to invest in products they need without paying the full cost upfront. This is particularly helpful for wholesale transactions, where orders are substantial in value.

- Improve cash flow for your business: Maintaining a steady cash flow is crucial for every business. Offering net payment terms gives your customers a reasonable timeframe to settle their invoices, which ensures timely revenue for your store.

- Stand out from competitors: One of the quickest ways to create a competitive advantage is to offer flexible payment terms. This demonstrates your commitment to providing solutions that cater to the distinct needs of your B2B buyers, thereby distinguishing you from the competition.

- Increase sales: Offering net 30/60 removes initial financial barriers to purchase, making your offerings more accessible to wholesale buyers. This can encourage both new and existing B2B buyers to make purchases more frequently, which results in higher sales for your business.

Key Considerations To Review Before Offering Net 30/60/90

While offering net 30/60/90 payment terms has its advantages, it may not apply to all types of businesses. No worries, we’re here to help you determine if it’s the right move for you! Below, we’ve outlined key factors to consider before implementing WooCommerce pay later options in your e-commerce store:

- Customer base: Net 30/60 payments would particularly benefit businesses that cater to wholesale customers. Take a good look at the clients you’re serving and evaluate their payment preferences.

- Customer relationships: Likewise, it’s crucial to assess the state of your customer relationships. Providing net payment terms requires clear communication from both parties, ensuring there’s a transparent understanding of payment expectations and deadlines.

- Average order value: Offering net payment terms may be more beneficial for businesses with higher order values, as larger transaction amounts mitigate the risks associated with deferred payments.

- Cash flow sustainability: Will offering extended payment terms affect your ability to sustain your operations? Before offering net payment terms, it’s important to assess if your business has enough liquidity to support this payment option.

How To Enable WooCommerce Pay Later And Offer Net 30/60 In Your Store

WooCommerce, by default, does not have an inherent feature to enable net payment terms. Fortunately, you can easily set up net 30/60/90 payments and create customized payment plans with plugins like Wholesale Payments!

Wholesale Payments, our newest addition to Wholesale Suite, empowers business owners like you to offer payment installments to your WooCommerce store. It provides unparalleled flexibility to create custom payment plans tailored to your business’ specific needs.

In this tutorial, we’ll assume you’ve already installed and set up the plugin. Setting up net 30/60/90 payments takes a few steps, so let’s begin!

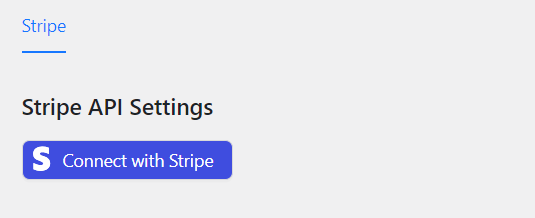

1. Connect your Stripe account to Wholesale Payments

The first step to setting up WooCommerce pay later options for your store is to connect your Stripe account to Wholesale Payments. This integration allows you to send out invoices to your customers seamlessly. It also gives your wholesale customers the flexibility to choose their preferred payment method when paying for their invoices.

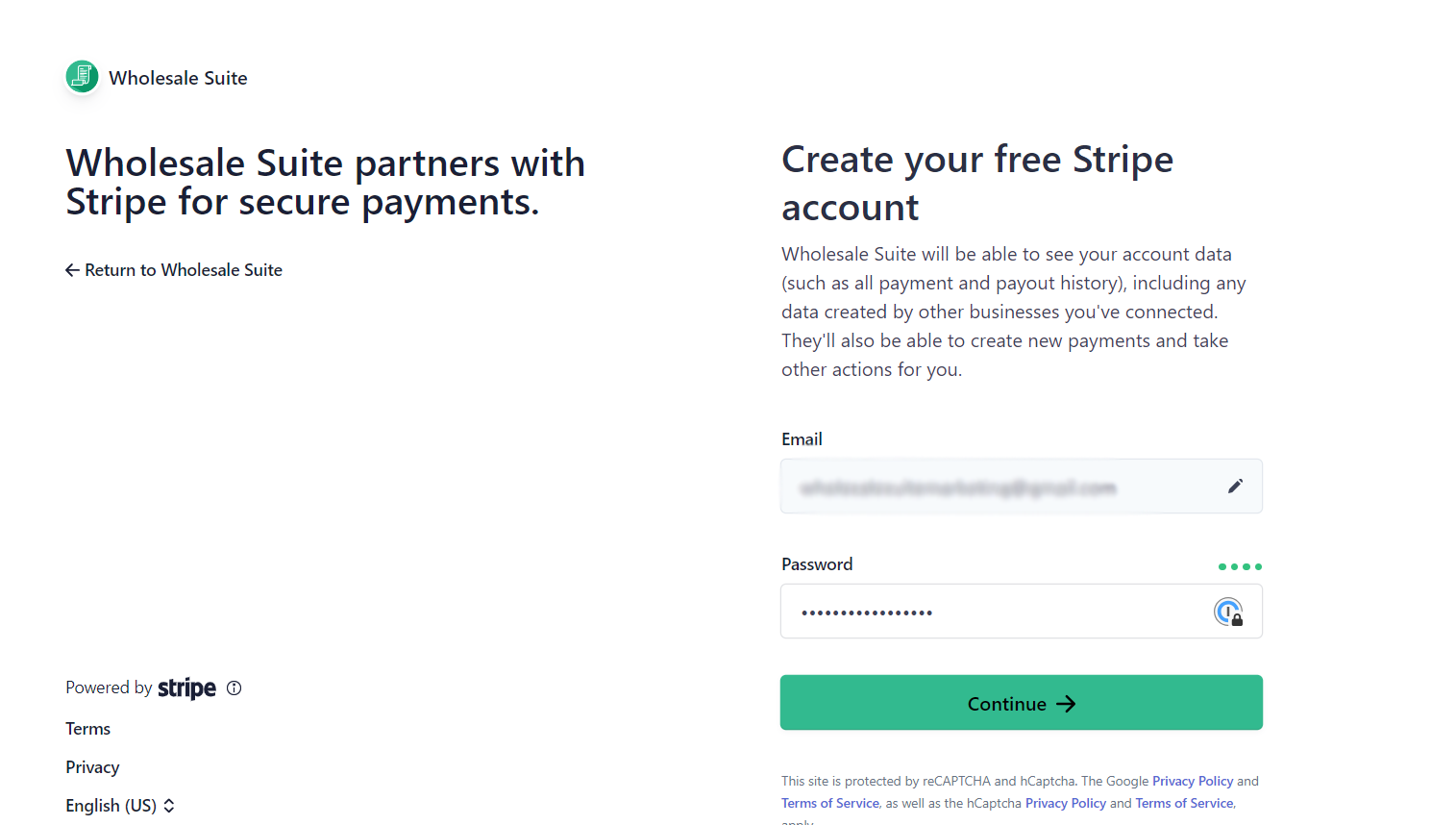

After installing Wholesale Payments, go to your WordPress dashboard and click Wholesale > Wholesale Payments. Then, click “Connect with Stripe”. This will direct you to the Wholesale Payments integration page. If you already have a Stripe account, simply enter your account details to connect it.

Alternatively, if you don’t have an existing Stripe account, you can easily create one right within Wholesale Payments. This saves you time and ensures seamless integration. Simply fill out your business details on the page to set up a new account.

After filling out the required details, a Stripe account will automatically be created for you.

2. Add Wholesale Payments to your WooCommerce Payment Methods

The next thing you need to do is to enable Wholesale Payments on your WooCommerce store. To do this, simply navigate to WooCommerce > Settings > Payments. In the Payments settings, locate Wholesale Payments from the list of available payment methods. Toggle the switch to enable Wholesale Payments and make it accessible to your valued customers.

Don’t forget to save your changes!

3. Enable net 30/60/90 payment plans

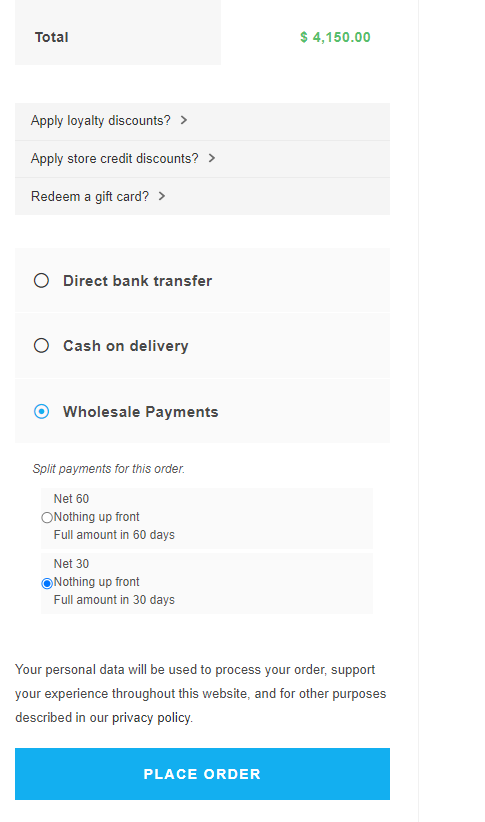

Now that Wholesale Payments is all set up on your WooCommerce store, can now enable your desired payment terms! To do this, navigate to Wholesale > Payments > Payment Plans.

Immediately, you’ll notice default payment plans already set up for you. These are pre-configured and can be enabled anytime, depending on the options you want to provide your customers.

To enable NET 30 payment terms, simply select the “Net 30” option from the available payment plans. You’ll also have the option to customize the payment plan name and description to align with your preferences. Once you’re satisfied with your selections, click “Save Changes” to create your first payment plan.

Similarly, to enable Net 60 payment terms, select the “Net 60” option, adjust the plan details as needed, and then save your changes.

4. Edit your payment plans (optional)

Upon saving your changes, your newly created payment plans are automatically enabled by default. This is how it will look on your dashboard:

To modify the settings of a specific payment plan, navigate back to the “Payment Plans” section within Wholesale Payments and hover over the payment plan you wish to edit. Then, click the “Edit” button in the right corner of the plan.

You can also choose to restrict the plan’s availability to specific wholesale user roles, providing tailored purchasing experiences for different customer segments. Likewise, you can also enable Auto Charge Invoices if you wish to charge your customers automatically on their next due date.

Note: You can create as many wholesale user roles as you want using Wholesale Prices Premium, another powerful plugin part of Wholesale Suite. This tool allows you to manage wholesale pricing in your WooCommerce store, tweak product visibility for wholesale customers, and create discounts for your B2B clients.

Don’t forget to hit “Save” once you’re satisfied with your changes!

Here’s how your configurations will appear for your customers:

Immediately upon placing an order, your customer will receive an invoice detailing the amount due and its corresponding due date. With Wholesale Payments, they have the flexibility to choose among their preferred payment methods (such as ACH Direct Debit or credit cards), ensuring convenience with the checkout experience.

Conclusion

Offering flexible payment terms can be a game-changer for your wholesale business! With WooCommerce pay later options, such as net 30/60/90 terms, you empower your customers with more choices, giving them more reasons to choose you.

In this detailed guide, we explore the concept of net payments, outline the benefits and key considerations, and walk you through how to implement it in your WooCommerce store using Wholesale Payments easily.

To summarize, let’s review the steps below:

- Connect your Stripe account to Wholesale Payments

- Add Wholesale Payments to your payment methods

- Enable net 30/60 payment plans

- Edit your payment plans (optional step)

Tools like Wholesale Payments allow wholesalers like you to effortlessly offer net payment terms and custom payment plans in your WooCommerce store.

Do you have any questions about net 30/60 payment terms? Let us know in the comments section below!

Frequently Asked Questions

What should I consider before offering net 30/60/90 payment terms to my wholesale customers?

Before offering these terms, evaluate your customer base, communication clarity regarding payment expectations, the average order value, and your business’s cash flow sustainability. These factors help determine if extended payment terms will benefit your specific business model.

How can I enable WooCommerce pay later options like net 30/60/90 in my store?

You can implement pay later options by using plugins like Wholesale Payments. This plugin allows you to set up customized payment plans, connect your Stripe account for seamless invoicing, enable the payment options in WooCommerce, and create or modify payment plans for net 30, 60, or 90 days.

How do I set up custom net 30/60/90 payment plans in Wholesale Payments plugin?

To set up custom plans, go to Wholesale > Payments > Payment Plans, select or create a new plan, choose the desired terms like Net 30 or Net 60, customize the plan details, and save the changes. These plans will then be available for your customers during checkout.

Can I modify or restrict the availability of payment plans for certain customer groups?

Yes, within the Wholesale Payments plugin, you can restrict specific payment plans to certain wholesale user roles and customize the availability, ensuring tailored options for different customer segments.

Do you support WooCommerce Subscriptions on your Plugins?

Hi David,

Wholesale Payments works with Stripe invoices, there’s no need for subscriptions in this scenario as it’s about moving large invoices into your online workflow.

For subscriptions, I’d recommend the FunnelKit Stripe plugin.

We also need to support WooCommerce Subscription with Net 30. Has this been tested?

I’m also interested in knowing whether the NET 30 payment method works with WooCommerce Subscriptions? And if so, can the admin get a renewal order notification for these renewal orders that are set to status “Pending payment”?

Hi Gbiran,

While Wholesale Suite does work with WooCommerce Subscriptions, the Wholesale Payments plugin doesn’t integrate with it at this exact moment. We do have this on our list.

Just to confirm, you’re looking to have each renewal generate a Stripe invoice for payment? And that invoice would be generated payable NET 30?