If you serve businesses in your WooCommerce store, then you know how important it is to offer flexible B2B payment solutions. With an efficient and reliable payment solution, you can satisfy the evolving expectations of wholesale clients and keep your company thriving.

With all the options available, where do you even start? We’re here to help. In this article, we discuss B2B payments in detail. We’ll walk you through your options, help you understand key terms, and teach you how you can implement a fast and reliable B2B payment system in WooCommerce.

If you’re interested to learn more, then keep reading!

What Are B2B Payments?

In the simplest terms, B2B payments refer to the financial transactions between two businesses for goods or services rendered. These transactions are the backbone of wholesale and trade, facilitating the flow of goods and services across industries.

B2B transactions are typically longer and more complex than B2C transactions. Unlike B2C where individual customers make smaller, one-time purchases, B2B entails longer payment terms, recurring transactions, bulk orders, and negotiated contracts. It also covers a wider range of payment methods (more on this later), from traditional checks and bank transfers to modern B2B payment solutions like EFTs and digital wallets.

The Most Common Types Of B2B Payment Solutions

There are several ways modern businesses can accept B2B payments. Understanding how these B2B payment solutions work can help you identify the best choice for your venture. Let’s quickly walk through your options below:

1. Paper checks

While the digital age has made online transactions more common, paper checks are still a prevalent form of payment in the B2B realm. In fact, according to industry insights, 81% of firms still use paper checks to pay other businesses.

This traditional payment method offers some advantages, including easier tracking. Businesses that write paper checks have a physical, tangible record which can make account reconciliation easier. However, they can take up a lot of time to process and present logistical challenges.

For instance, cheques have to be mailed, deposited, and cleared by banks. This can present delays in the availability of funds and cause cash flow challenges for businesses with tight financial schedules.

2. Credit cards

Credit cards are also part of the most popular B2B payment solutions. This method is widely accepted, allowing business owners to conveniently transact with suppliers both locally and internationally.

One key advantage of credit cards is access to a line of credit. With this payment method, businesses can make essential purchases and keep operations running. This can be particularly beneficial to small and medium-sized enterprises (SMEs) that face fluctuating cash flow cycles.

One thing to keep in mind about credit cards is that they incur interest rates. To avoid incurring hefty interest charges, businesses opting for this method should monitor their credit limits and manage their payments responsibly.

3. Debit cards

Unlike credit cards that give businesses access to a line of credit, this payment method pulls directly from a business bank account. It works similarly to cash or checks but allows real-time funds transfer, giving businesses a convenient way to pay. The downside lies on flexibility–often, debit cards have spending limits, which can be a hindrance for larger or recurring transactions.

4. Wire transfers

Wire transfers are typically used in international transactions or large purchases. It entails an electronic funds transfer from one bank account to another, often administered by banks of third-party payment service providers. Their advantage includes speed and efficiency. Unlike traditional methods like checks, wire transfers reflect almost instantly.

However, compared to other B2B payment solutions, this method can be costly, coming with high processing fees. They’re also irreversible once initiated, making them less suitable for recurring business payments.

5. ACH (Automated Clearing House) payments

ACH works similarly to checks or bank transfers, allowing the electronic transfer of funds between two banks within a so-called “Automated Clearing House Network”. This network is managed by the nonprofit organization NACHA.

Some of the key advantages of this payment method are their convenience and affordability. Compared to other B2B payment solutions like credit cards or wire transfers, ACH payments have lower processing costs. They’re also highly secure, as the ACH netword adheres to strict industry standards for fraud prevention.

6. Digital payment platforms

More and more B2B companies are shifting their transactions online. Gartner predicts that 80% of B2B sales transactions will occur in digital channels by 2025. Key advantages of going digital include speed, efficiency, and convenience. Unlike traditional B2B payment solutions, digital payment platforms facilitate near-instantaneous fund transfers, which can help businesses manage their cash flow better.

This payment method also automates key aspects key aspects of the B2B payment process. Features like automated invoicing, easy B2B terms setup, and real-time transaction tracking allow e-commerce store owners to save time and gain more visibility into the financial health of their business. What’s more, these solutions integrate seamlessly with platforms like WooCommerce, allowing businesses to accept payment directly in their online stores.

Challenges Faced By Store Owners Regarding B2B Payment Solutions

As we’ve discovered, different B2B payment solutions offer distinct advantages and disadvantages. Depending on what methods you choose to offer for your business, you might encounter some common industry challenges. Careful planning and strategizing can go a long way to overcoming these hurdles:

1. Delays

Traditional B2B payment solutions like checks require a processing time and physical delivery, which can lead to delays in fund availability for your business. This can particularly be challenging if you’re dealing with a limited cash flow.

As wholesalers, you typically stock on large inventory and make timely payments to vendors to optimize your supply chain. These days can be a potential disruption, leading to inventory shortages, missed opportunities, or late payments to suppliers.

2. Hefty transaction fees

Processing fees, conversion fees, and intermediary fees that are required by some B2B payment solutions can quickly add up and affect your bottom line. This can negatively impact wholesalers who frequently engage in high-volume transactions and operate on thin profit margins.

3. Transparency and security

Traditional payment methods often lack real-time tracking capabilities, which can affect how businesses reconcile their transactions and assess their financial health. Without access to up-to-date financial information, it can be difficult for business owners to monitor their cash flow, identify discrepancies, or even detect potential fraudulent activities. Unfortunately, B2B payment fraud continues to be a prevalent industry problem, costing businesses billions in lost revenue.

4. Lack of payment terms flexibility

The expectations of B2B shoppers have evolved, and they typically seek flexible and convenient payment terms that align with their cash flow requirements. Due to the size and scale of B2B transactions, it’s norm to offer installment options or deferred payment plans.

Unfortunately, not all B2B payment solutions can accommodate these expectations. Methods like checks or wire transfers leave little to no room for customization and negotiation. This can potentially dissatisfy customers, leading to missed opportunities and strained business partnerships.

How To Offer B2B Payment Solutions In WooCommerce

After going through those challenges, let’s check out the good news–integrating digital B2B payment solutions into your WooCommerce store can help you solve these problems!

By leveraging plugins like Wholesale Payments into your WooCommerce store, you can offer flexible payment terms to B2B buyers, automate invoicing, gain real-time visibility into transactions, and streamline your whole B2B payment process.

Wholesale Payments not only allow you to offer flexible B2B terms– this plugin also supports several payment methods like ACH direct debit, credit cards, and digital wallets, helping you provide a convenient payment experience on your WooCommerce store.

So, let’s check out how you can offer B2B payment solutions in WooCommerce using Wholesale Payments in just two steps!

Step 1: Install and activate Wholesale Payments

The first step is to install and activate the plugin. Then, once you have installed and activated Wholesale Payments, you’ll need to:

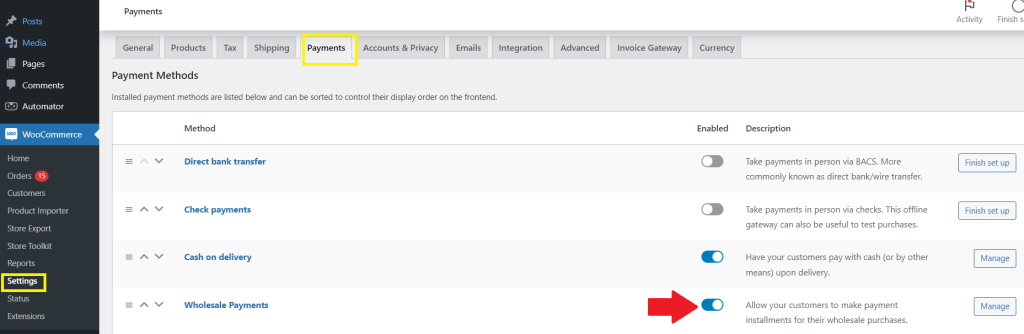

- Enable it as a payment method. To do so, simply navigate to your WordPress dashboard > WooCommerce > Settings > Payments. Then, scroll down to locate Wholesale Payments and switch it to “Enabled.”

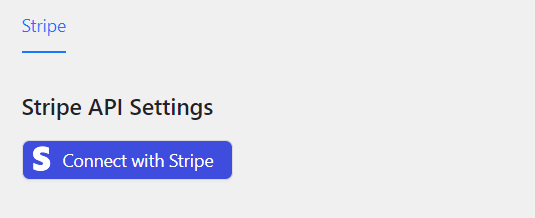

- Connect your Stripe account to Wholesale Payments. Wholesale Payments seamlessly integrates with Stripe, allowing you to accept secure and versatile payment methods in your WooCommerce Store. To connect with Stripe, navigate to Wholesale > Wholesale Payments. Then, click the “Connect with Stripe Button”.

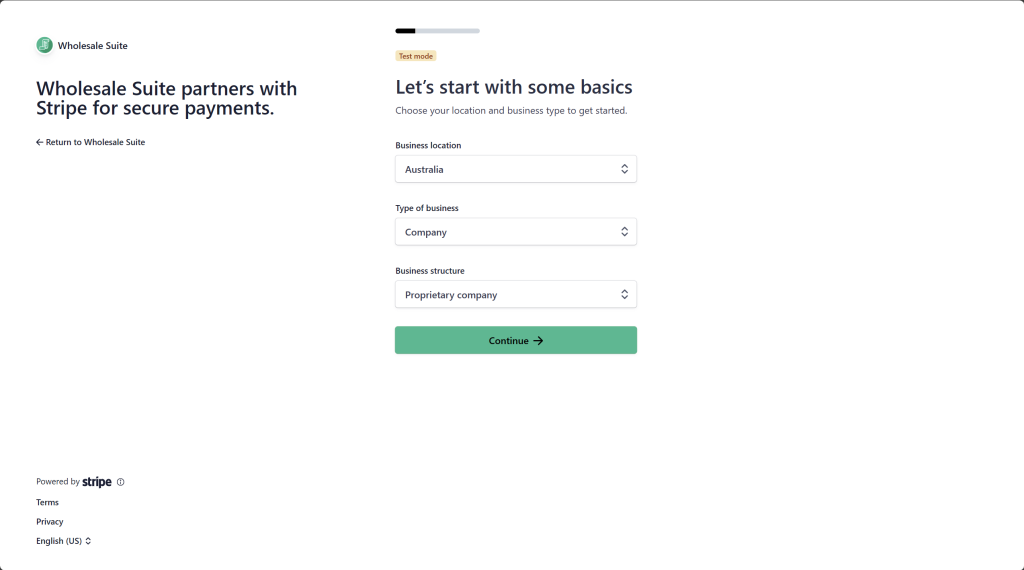

This will bring you to Stripe’s onboarding page where you can either connect your business’ existing Stripe account or create a new one by following the prompts on the page:

Once your Stripe account is successfully integrated, you’ll be able to view your account’s unique API settings once you’re redirected to the Wholesale Payments page.

Step 2: Enable B2B payment terms on your WooCommerce store

One of the key advantages of integrating Wholesale Payments in your store is that it allows you to offer flexible B2B payment terms. What’s more, you can customize the terms in any way you want. Let’s take a quick look at your options.

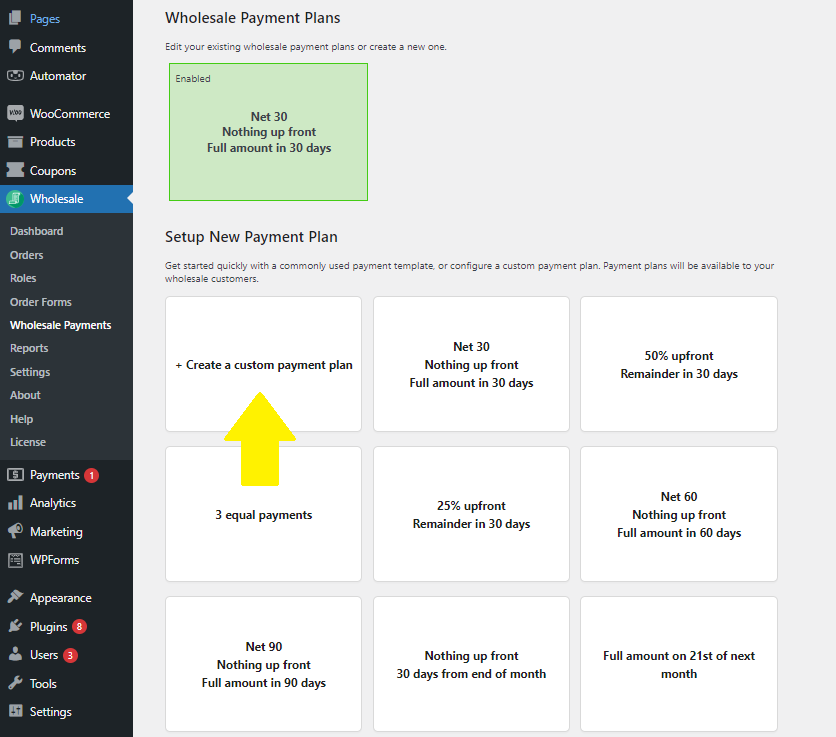

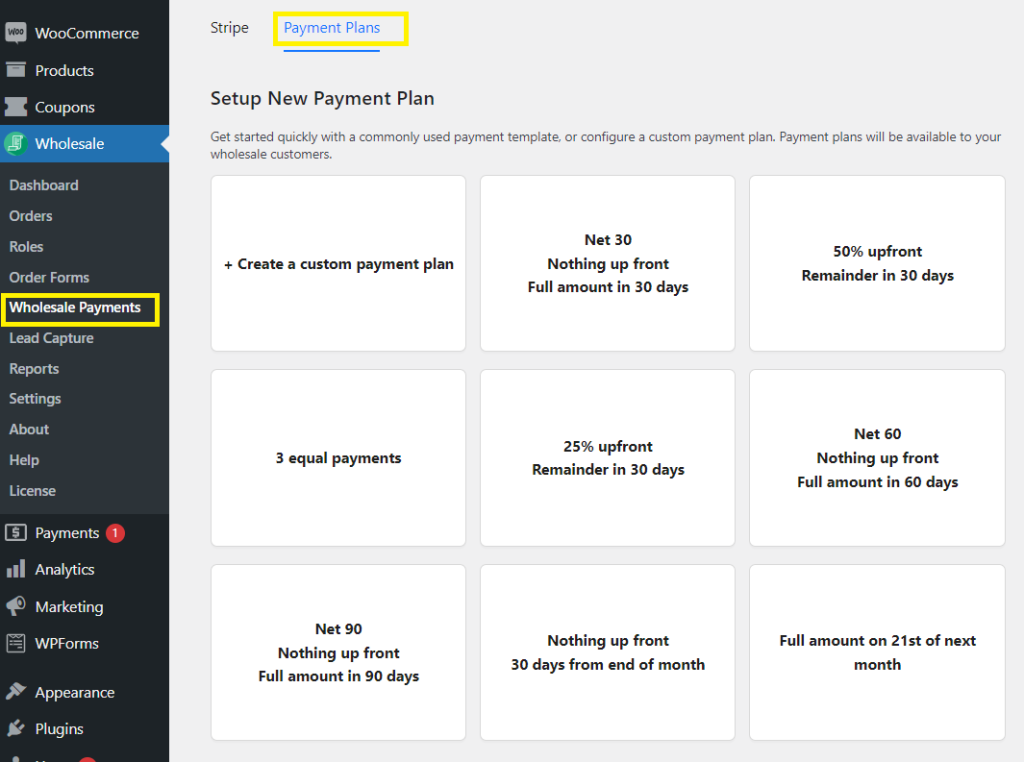

Navigate to Wholesale > Wholesale Payments > Payment Plans. Out of the box, the plugin gives you a selection of default payment terms that you can enable at any time:

To enable a default payment plan, simply click on the plan you wish you to offer, edit the plan name and description (this is optional), and click “Ok”. You’ll notice that it’ll automatically show up on your enabled payment plans.

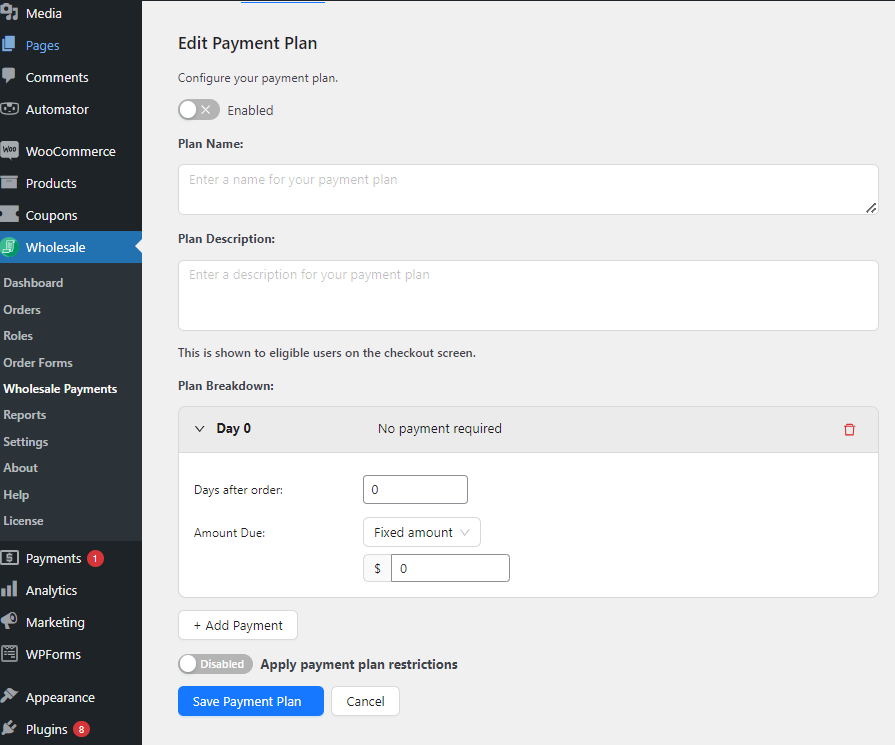

The other option is to create your own custom payment plan. To do so, simply click “Create custom payment plan.”

This will take you to the Edit Payment Plan screen, where you can modify your plan any way you want:

Check out our detailed tutorial about creating custom payment plans with Wholesale Payments here!

💡Power Tip: Wholesale Payments also allows you to make payment plans available only to certain wholesale roles or wholesale users. To apply restrictions, toggle “Payment Restrictions” and select the roles or users you want your payment plan to be exclusive to.

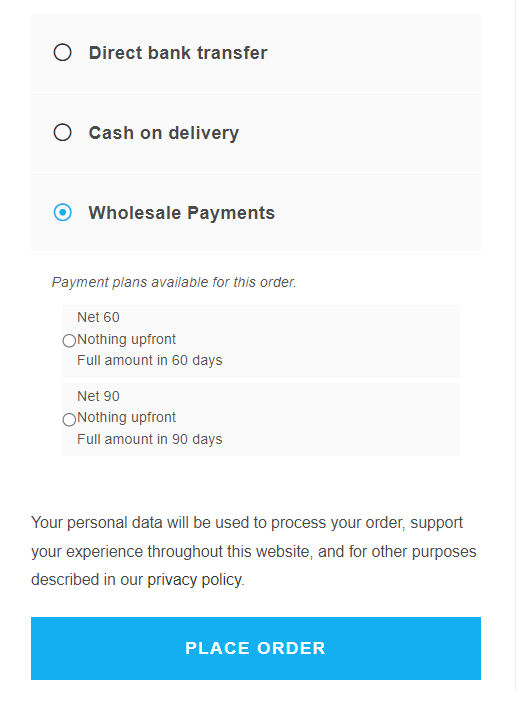

After doing the two steps above, customers can now select your offered payment terms upon checkout:

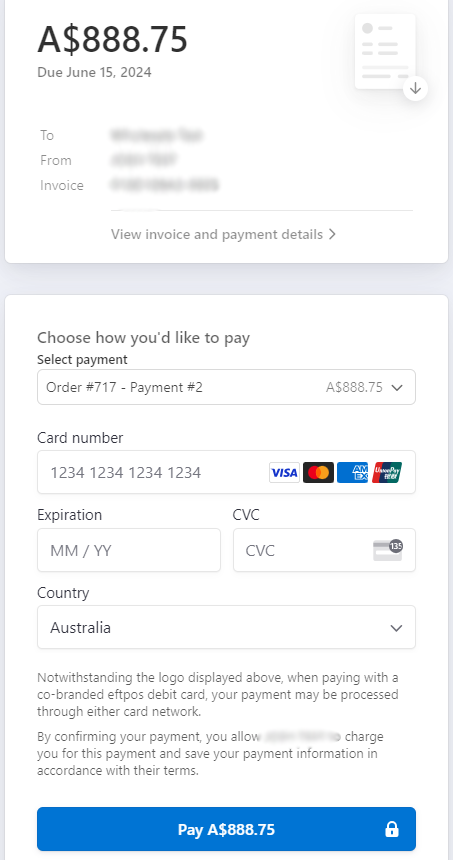

Upon placing a successful order, an invoice will be automatically sent to the customer. To make things more convenient, they can pay with their preferred payment method:

Related Articles

Want to learn more about Wholesale Payments or WooCommerce B2B payments? Check out our detailed guides below:

- WooCommerce Wholesale Payments Getting Started Guide

- How To Streamline WooCommerce Invoicing With Wholesale Payments

- How To Offer WooCommerce Split Payments To Wholesale Customers

- Empower Your Wholesale Customers: Offer WooCommerce Partial Payments

Conclusion

WooCommerce wholesalers and online business owners can stand out in the modern B2B landscape by offering flexible and convenient payment solutions. In this informative article, we’ve reviewed the most common types of B2B payment solutions:

We’ve also looked into the unique challenges posed by these solutions, and how you can address them with tools like Wholesale Payments! With Wholesale Payments, you can offer B2B payment solutions in WooCommerce in just two steps:

So, are you ready to elevate your WooCommerce business with B2B payment solutions? Do you have a question in mind? Let us know in the comments section below!