Increased market competition and evolving customer expectations in the B2B industry have made it more challenging to stand out. If you’re looking for a way to attract and retain customers, then you should consider offering flexible payment plans. Today’s wholesale customers are more likely to partner with businesses that cater to their unique financial requirements and provide tailored solutions.

Bookmark this article, for we’ll be diving into everything you need to know about flexible payment plans. We’ll walk you through what it is, why it matters, and how you can start implementing it in your wholesale store. So, let’s get right into it!

Understanding Flexible Payment Plans

Flexible payment plans allow wholesale customers to spread out their payments over time, rather than pay the full amount of their order upfront. This arrangement empowers B2B customers to make large purchases without straining their financial resources. By offering flexible payment plans, you give wholesale clients greater control over their cash flow and encourage them to choose your business.

Here are some of the most common types of flexible payment plans offered in the wholesale industry:

- Installment plans: In this arrangement, wholesale customers pay their order in multiple installments over a specific time period. For example, your business might allow B2B customers to split the cost of their order into four equal installments, paid every 30 days.

- Deposit-based payment: Alternatively, buyers can make a partial deposit upon order, with the remaining balance due at a later date.

- Buy Now, Pay Later (BNPL): This payment model allows wholesale customers to make purchases upfront and defer payment at a later date.

- Custom payment plans: In some cases, wholesale businesses work with individual clients to tailor payment schedules based on their specific financial requirements and order value.

Key Benefits Of Offering Flexible Payment Plans In Wholesale

Before offering flexible payment plans in your e-commerce store, it’s beneficial to understand the key advantages they offer for your business. In this section, we’ll explore how this strategy can help you drive growth and create better customer relationships.

1. Meet customer expectations and keep them happy

Offering flexible payment plans is expected in wholesale. Terms like NET 30/60/90 have been standard practice in the offline B2B realm for decades. As B2B transactions shift online, wholesale customers expect the same level of flexibility in their payment terms.

What’s more, according to industry insights, B2B buyers are more loyal to businesses that deliver seamless payment experiences. The same research reveals that 83% of B2B buyers place importance on having a variety of payment options available when considering suppliers. By integrating flexible payment plans into your e-commerce store, you can meet evolving customer expectations, keep clients happy, and build loyalty in the long run.

2. Maximize revenue and improve cash flow

Providing flexible payment plans makes your products more accessible and affordable to new and existing customers. With an option to spread payments over time, wholesale customers feel more confident in committing to higher-value orders. As a result, you enjoy increased average order values and higher revenue growth.

It’s also beneficial to your cash flow. With wholesale customers availing of flexible payment plans, you create a more predictable and steady flow of revenue from installment payments. This can help you manage your financial resources better and capitalize on opportunities to grow your business.

3. Stand out from the competition

With countless other businesses vying for customers’ attention, it can be tough to stand out from the crowd. Providing customers with convenient payment choices makes it easier for them to do business with you, encouraging them to choose you over competitors.

Moreover, it demonstrates your commitment to catering to diverse financial circumstances, which greatly vary in the B2B industry. According to industry insights, six in ten small businesses struggle with their cash flow. By offering varied payment options and plans, you empower them to make purchases that align with their current financial capabilities.

As B2B transactions continue to shift online, adapting to consumer preferences has become necessary for sustained business growth. Embracing this early can help position your business for success in the long run.

Factors To Consider When Offering Flexible Payment Plans

As we’ve discovered, offering flexible payment plans yields several advantages for your wholesale business. However, to make this strategy work for you, it’s essential to evaluate factors that may affect the effectiveness of your payment strategies.

Let’s quickly review them below:

1. Your business’ financial stability

Before offering payment options to wholesale customers, it’s crucial to assess the financial stability of your business first. Evaluate whether your business can support these payment arrangements sustainably. Start by looking into your cash flow, revenue streams, and profit margins.

While offering flexible payment plans can improve your cash flow in the long run, it’s also important to make sure your current obligations will be accounted for. This includes your operational expenses, supplier payments, or any outstanding debts.

Remember to strike a balance between meeting customer needs and ensuring the growth and stability of your business. To mitigate any risks, consider strategies like establishing reserve funds or setting credit limits to wholesale customers.

2. Credit risk assessment

There’s always a risk when it comes to providing longer payment terms, but you can significantly minimize them by conducting credit assessments on your customers. This begins right in the onboarding process. Before giving wholesale customers access to flexible payment terms, make sure you gather relevant information, taking into account factors like business longevity, size, and industry reputation.

Learning about your customers can help you make more informed decisions about extending payment terms, and thereby minimize the risks associated with this. Another option to consider is tailoring personalized payment solutions. For example, you may consider extending payment terms only for long-standing customers. This may include B2B buyers with a proven track record of timely payments or those loyal to your brand.

3. Payment processing tools

Selecting the right tool to handle all of this for you is another crucial consideration. After all, your goal is to streamline and automate the payment process to give your wholesale customers the best experience possible. This entails investing in solutions that offer the following:

- Seamless integration with your e-commerce platform: Your tool should seamlessly integrate with your online shop, whether you’re selling wholesale in WooCommerce, Shopify, Squarespace, or Wix.

- Allows multiple payment methods: To give your B2B buyers the best experience, make sure that your tool supports a wide range of payment methods. This may include credit cards, debit cards, digital wallets, bank transfers and more.

- Provides detailed reports and analytics: You can save a ton of time and improve your overall payment management process by investing in a tool that gives you full transparency and visibility into payments, outstanding balances, and customer behavior.

- Secure and compliant: Lastly, you’ll want to ensure that your chosen tool adheres to industry standards and offers advanced encryption capabilities to protect the data of your customers.

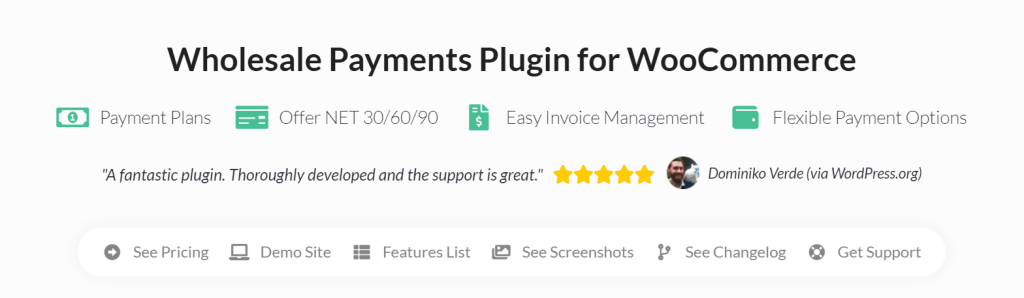

Offering Flexible Payment Plans With Wholesale Payments

If you’re convinced that offering flexible payment plans is the right move for your business, then you’re in luck! Wholesale Payments, our newest addition to Wholesale Suite helps you do just that. With this game-changing plugin, you can:

- Offer flexible payment terms to wholesale customers: Wholesale Payments come with a set of pre-configured payment plans such as NET 30/60/90 that you can enable for your WooCommerce store.

- Create custom payment plans: With this powerful plugin, you can craft custom payment terms and structures based on the unique requirements of your wholesale customers.

- Gain complete visibility into outstanding balances and transactions: Transparency is key for optimal cash flow management. Wholesale Payments allows you to monitor payments and outstanding balances right within your WooCommerce dashboard, saving you time and making sure you’re on top of things.

- Automate invoicing: The plugin sends out automatic invoices right after wholesale customers place an order. It also provides them with the option to pay right within their invoices.

💡 If you want to learn more about how Wholesale Payments can revolutionize your wholesale business, check out our helpful guides and tutorials below:

- Wholesale Payments Getting Started Guide

- How To Streamline WooCommerce Invoicing With Wholesale Payments

- How To Offer WooCommerce Split Payments To Wholesale Customers

- Empower Your Wholesale Customers: Offer WooCommerce Partial Payments

- How To Create Custom Wholesale WooCommerce Payment Plans

- How To Offer WooCommerce Deposits For Wholesale Orders

Wrapping Up

Offering flexible payment plans is a powerful strategy to stand out in today’s competitive B2B market. As B2B transactions continue to shift online, wholesale customers seek streamlined payment processes that meet their evolving needs. In this article, we’ve reviewed the following key advantages of offering flexible payment plans:

- Allows you to meet customer expectations

- Helps maximize revenue and improve cash flow

- Gives you a competitive edge

We also walked you through essential factors to consider to ensure the success of your payment strategy:

Finally, we introduced you to a revolutionary plugin in the WooCommerce B2B space–Wholesale Payments. With this powerful plugin at your fingertips, you can begin offering flexible payment terms and custom payment plans to wholesale customers.

Do you have any questions about this article? Let us know in the comments section below!