Some companies and organizations you do business with might ask you to provide tax exemption options in your online store. Whether they can easily see that exemption at checkout is something that might have a big impact on their decision to shop with you.

However, with WooCommerce, you’re fortunate because you can enable tax exemptions for certain user roles. This is made possible through the Wholesale Suite plugin. With the features included, you can create wholesale user roles and configure specific options, like tax exemption, to them.

In this article, we’ll explore how to enable tax exemption options for wholesale user roles. We’ll also discuss when this might be helpful for your online business. Let’s jump right in!

Tax Exempt Wholesale Customers Using User Roles

When you sell products to a mix of retail and wholesale customers, there are certain provisions you might have to make. Honoring a tax exemption status is one of them. However, by doing so, you are implementing helpful customer service practices. This can help you grow your business in the long term.

Essentially, when someone purchases items they intend to resell, they can qualify for tax exemption – this depends on where you do business and what your local tax laws are. It’s best to consult your tax advisor to get clarity around when you should tax-exempt wholesale customers.

Determining when to apply tax to an item can get tricky. If you have a brick and mortar location for your store as well as an online option, you likely need to apply sales tax to certain items.

In spite of tax code complications, if you are dealing with a mix of customers, being able to offer tax exemptions according to customer roles in WooCommerce can be very useful. This is also a good option when you have customers who are registered as tax-exempt nonprofit organizations.

As we mentioned before, catering to customers who qualify for tax exemption shows you care. When you make it easier for your shop users to make economical purchases, they are more likely to make your store a usual stop.

How to Provide Tax Exemption to Wholesale User Roles in WooCommerce (In 3 Steps)

With WooCommerce Wholesale Prices Premium, you can map tax exemptions to your wholesale user roles. This is all done through your WordPress admin panel in just three steps. Let’s take a look!

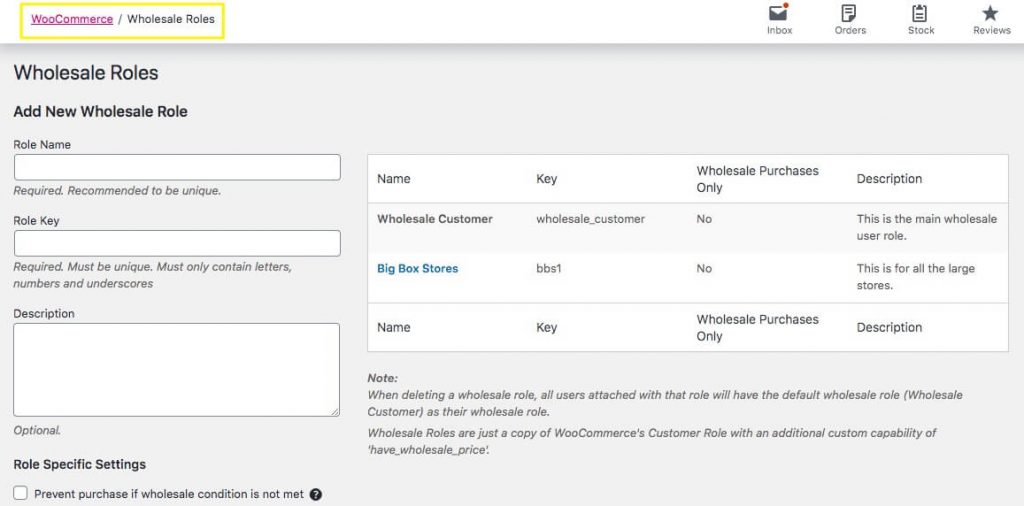

Step 1. Add custom user roles for tax exemption mapping

Adding a new user role in WooCommerce is very straightforward. It’s just like adding Categories in WordPress, in fact. You can navigate to WooCommerce > Wholesale Roles and create a new role:

Here, you can easily name your new role and write a description. Once that’s all set up, click Add New Wholesale Role at the bottom of the page. You’ll now be able to access this role for mapping tax exemptions.

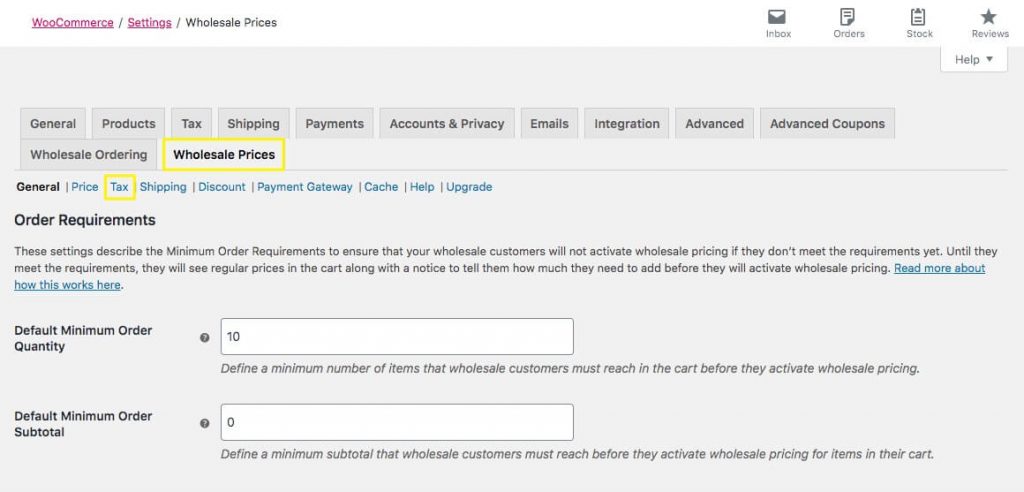

Step 2: Map tax exemption rules to your new wholesale user role

Next, head over to WooCommerce > Settings in your WordPress dashboard menu. Here, you want to click on Wholesale Prices first, then click on Tax:

Don’t be confused by the other tab labelled ‘Tax‘. That particular settings tab belongs to the WooCommerce plugin.

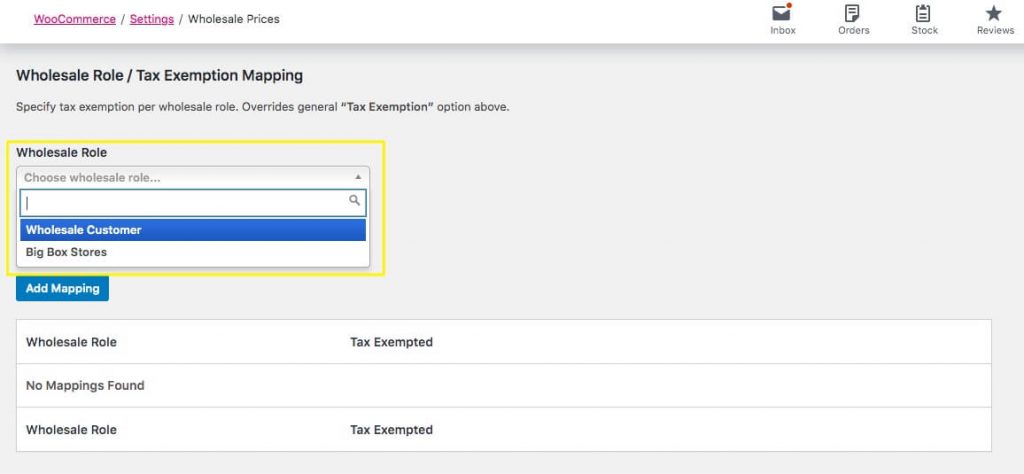

Once you open the Wholesale Prices > Tax settings, you’ll find the tax exemption options about midway down the screen. Here, you’ll first choose the Wholesale Role you want to map:

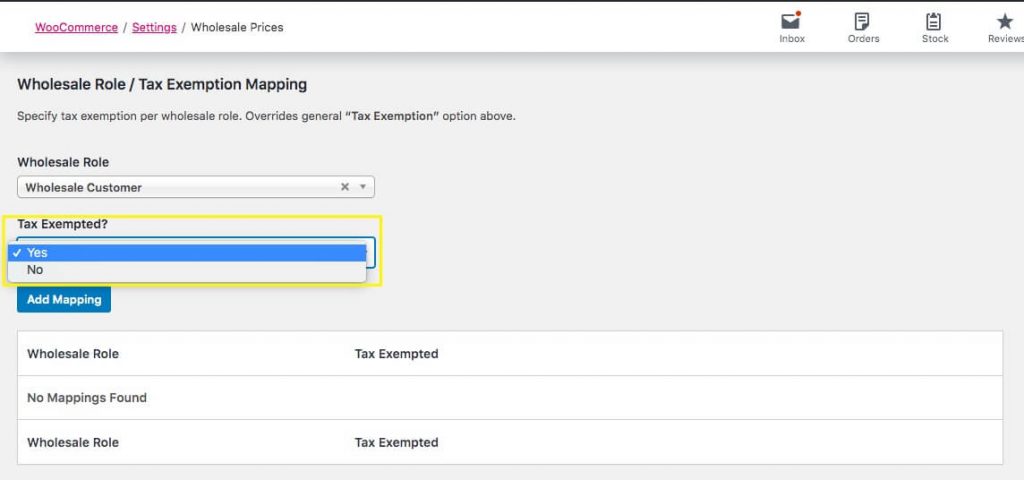

Next, you need to choose ‘Yes’ or ‘No’ from the next dropdown menu. This tells your online shop whether anyone who has that role should also be tax exempt or not:

Once you’ve made your selections, click Add Mapping and then Save Changes at the bottom of the screen.

Step 3: Test the tax exempt mapping

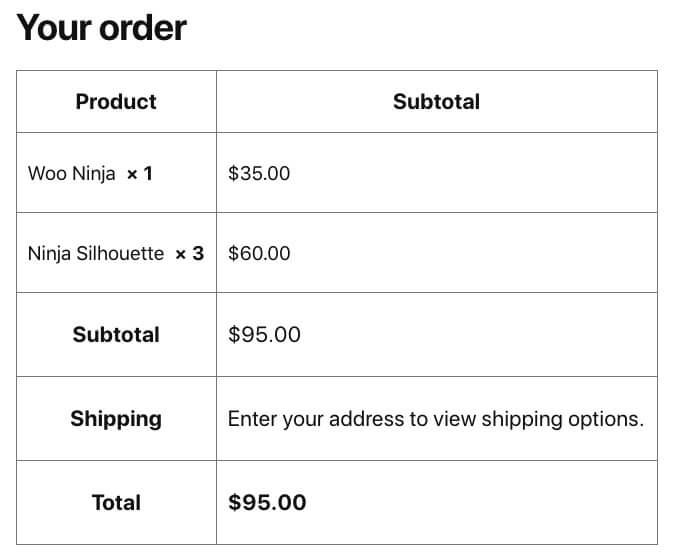

We recommend creating a wholesale test user role in order to ensure your exemptions are working properly. Once you create your test user, you can visit your own shop and if everything is working correctly, you should not see tax applied to your wholesale order:

If your checkout screen displays no additional taxes, you can consider your job done. You mapped a tax exemption status to a wholesale user role in WooCommerce! Now your customers can enjoy your excellent customer service and make purchases free of tax.

Conclusion

Making sure your customers have a frustration-free experience is a big part of running an online store. Being able to easily honor their tax exemption is one way Wholesale Prices Premium is used to meet customer needs and expectations.

Mapping wholesale user roles to custom tax settings takes just three steps, including:

- Add a new custom wholesale user role in WooCommerce.

- Map a tax exemption status to the new user you created.

- Test your new settings by creating a test user.

Do you have questions about how to map tax exemption to a custom wholesale user role in WooCommerce? Share your thoughts with us in the comments section below!