You’ve probably encountered the minimum order quantity (MOQ) requirement suppliers frequently require as a wholesaler. That means that every now and then, manufacturers, suppliers, and distributors will reject some customers if they are unable or unwilling to place the required minimum order volume.

It may seem strange that refusing business could result in increased profits, but it’s crucial to understand how minimum order quantities work and why you yourself can use them, especially in low-margin or highly specialized enterprises.

In this article, we’ll walk you through the basics of the minimum order quantity formula. Then, we’ll show you the benefits of using it and how it impacts your inventory and sales. Lastly, we’ll give you a quick guide on how you can calculate minimum order quantity. Let’s get started!

What Is A Minimum Order Quantity (MOQ)?

The least number of units a business is willing to sell to a customer at once is known as the minimum order quantity. Although a merchant can set MOQs for various orders, manufacturers and suppliers generally use them in e-commerce when referring to a manufacturing run.

Consider, for example, that a wholesaler sells lamps for $20 each. The minimum order quantity for lamps from the supplier is 200 units, or at least $4,000. The MOQ can be calculated in terms of dollars or units. In any case, this MOQ represents the threshold at which the business can earn from a specific order.

There are a bunch of reasons why businesses need an MOQ, but in general, the objective of an MOQ is to limit sales and inventory to transactions that will only increase your profit margin.

Why Do Suppliers Require Minimum Order Quantity (MOQ)?

Like every business, suppliers are subject to a variety of expenses and limitations. Of course, in order to keep their store alive and thriving, they need to be certain they earn from each order in some capacity.

Suppliers typically use MOQs for one reason: selling margin, or the revenue generated by the sale of a good or service. If a supplier offers goods with a low markup or a narrow margin, it may require a significant amount of sales to break even after accounting for overhead and other ongoing expenses.

Industries set their MOQs for various reasons and in distinct ways. For instance, a manufacturing company that needs to start up a production run may incur high upfront expenses. This makes the venture hard to sustain until it sells enough units to offset those costs.

Similarly, MOQ helps in better inventory management in wholesale e-commerce businesses like yours. This is because it lets you track and estimate the running stocks and order a few more without losing sight of the profitability ratio.

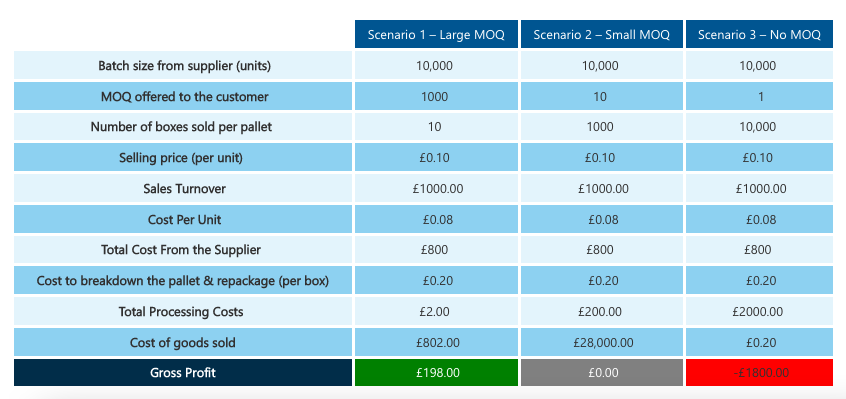

To help us better understand the importance of MOQs, here’s an example from Slimstock:

The supplier gets a sizable profit in scenario 1. Meanwhile, the supplier doesn’t generate any profit at all in scenario 2, because the customer order amounts are substantially lower.

Even worse, the vendor would really incur a loss on each transaction if they permitted customers to purchase single units as in case 3.

You may already know this, but for wholesalers, selling products in minimal quantities, even a single unit at a time, has absolutely no financial benefit to your store. Worse, it can even hurt your bottom line.

And for this reason—to protect their profitability—suppliers demand minimum order numbers.

How Minimum Order Quantity Impacts And Benefits Your Store

Both the customer and the seller’s inventory are significantly impacted by minimum order numbers. The MOQ has an effect on how sellers handle inventory because it forces them to manufacture and possibly warehouse huge volumes.

On the other hand, buyers must determine whether they will require at least the MOQ of a product or if they will need to find a supplier with a lower MOQ or think about inventory storage solutions.

Either way, inventory is heavily considered when calculating for MOQ.

This also means that for both buyers and sellers, properly managed MOQ can also benefit both ends. For buyers, it helps in regulating the prices or helping them save more. On the other hand, it can serve as an effective inventory management control for sellers.

Benefits for wholesalers, suppliers, or distributors

- Inventory Control – with a minimum quantity requirement, you can have a better foresight of the number of stocks that need to be produced and constantly updated.

- Reduced Inventory Expenses – MOQ helps decrease the usage of warehouses, which, in turn, reduces the expenses on inventory spaces.

- Improved Profit Margins – Suppliers can better regulate their profit margins by managing MOQs, ensuring that products are only produced when there are significant earnings supporting the order.

Minimum Order Quantity Considerations: The First 2 Things To Think About

While MOQ may seem like a complicated matter to decide on, it’s easy to calculate if you bear two things in mind:

1. Raw materials

When determining your MOQ, this is perhaps the most significant factor. Specific quantities of raw materials are sold in order to make a specific number of parts. The MOQ is that quantity.

For example, a supplier has a polymer with a 300 kg minimum order quantity, or 5,000 units. However, the customer only needs 1,000 products a year. The provider must nevertheless purchase the full 300 kg even though the customer obviously doesn’t need them all.

In this scenario, the cost of the raw material will often be borne entirely by the customer. A MOQ is a guarantee that a supplier won’t have to pay for extra material.

2. Order volume

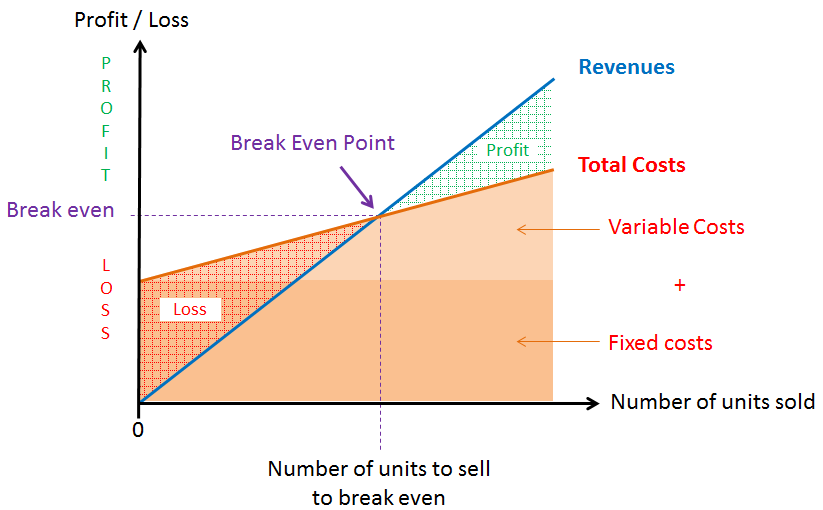

Next, you need to find the break-even point for when an order will begin to make a profit. Suppliers should think about their current and prospective customers before establishing MOQs.

The MOQ, for instance, will probably be significantly lower if its chief market consists of small retailers rather than large retail chains.

Additionally, product prices will need to be modified properly. If the supplier typically sells high-volume, low-margin merchandise, they could require a high MOQ to break even.

How To Calculate The Minimum Order Quantity

Now that you have a clearer picture of how MOQ works and need it in your business, let’s start calculating!

The truth is, however, that there is no ABSOLUTE formula.

Due to the diversity of business needs, there is no ideal MOQ. Naturally, having a higher MOQ or paying a higher price per unit is typically a trade-off. But again, each wholesale business targets different industries, and not all consumer bases are the same.

This means that there isn’t really a 1+1 formula you can follow to calculate it.

Regardless, we prepared a step-by-step guide below on how you can start figuring out your MOQ. This will make it easier for you to determine what would work best for your business:

Step 1: Forecast your demand

The first step is to consider the demand for your products. By estimating future sales and revenue, demand forecasting helps the business make more educated supply decisions.

You can get on with this by analyzing your previous sales data. From there, you can estimate the potential sales and, thus, maximize your inventory. Take a look at this, for instance:

If you have a history of receiving orders for 200 units or fewer, imposing a MOQ of 2,000 units overnight might not be possible. Not only will you have to worry about your inventory level, but you’ll also have to make an extra effort to sell 10x more!

When demand forecasting, you also have to factor in the seasonality and lead periods, or how long it takes to produce an order.

This step will help you make well-informed decisions about anything from inventory planning and warehousing requirements to running flash sales and satisfying consumer expectations. Here are additional strategies to keep an eye on your demand:

- Keep in close communication with your provider(s)

- Make sure you have enough safety stock on hand to handle any large demand changes

- To easily adjust production numbers, review weekly, if not daily, sales estimates

Step 2: Determine your holding expense

Are you paying for inventory? If so, how much are you paying for the storage?

The cost of storing some items is higher than for others (due to size, duration of storage, and special warehousing requirements). Making sure such things aren’t retained in your inventory for an excessively extended time is financially advantageous.

Step 3: Find the break-even point

The break-even point is a crucial calculation for businesses since it applies to many different aspects of running a company. For MOQ calculation, for instance, the break-even point is important because this is where you realize your profit margin.

You may figure out your company’s break-even point using a few straightforward formulas:

- Based on the number of products sold or units

- Based on points in sales dollars

Let’s give each formula a closer look!

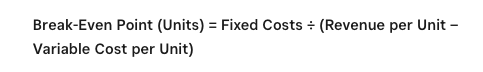

Based on the number of products sold or units

When calculating the break-even point based on units, divide fixed costs by the revenue per unit minus the variable cost per unit:

No matter how many units are sold, the fixed costs remain the same. The difference between the price you are selling the product for and the variable costs, such as labor and materials, is your revenue.

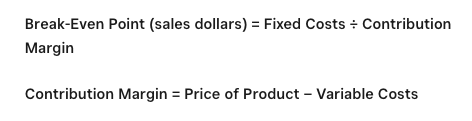

Based on points in sales dollars

Here, sales dollars can be computed by dividing the fixed costs by the contribution margin.

When calculating the contribution margin, variable costs are deducted from the product’s price. The fixed costs are then covered using this sum.

Step 4: Finalize your MOQ

Once you’ve covered all the previous steps, you can now determine your MOQ.

Let’s assume that your demand is continuously high. On average, your partners buy 300 units per order, so in order to turn a profit, you must sell at least 250 units per order.

You could lower your minimum order quantity to 250 units if your business partners or customers have previously agreed to purchase orders of 300 units.

It’s pretty easy now that you know all the fundamentals, right?

Conclusion

Inventory is often a company’s most valuable asset in the world of e-commerce. Therefore, it is crucial for wholesalers like you to confirm that every item in your inventory is generating a profit.

A minimum order quantity requirement is one way to accomplish this. In this article, we’ve shown you how to determine the MOQ in four steps:

Do you have any questions about calculating your minimum order quantity (MOQ)? Let us know in the comments below!